News

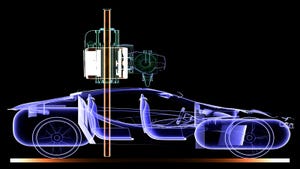

Toyota's Princeton, Indiana plant.

Automotive Engineering

Toyota Announces Indiana Production for New 3-Row Electric SUVToyota Announces Indiana Production for New 3-Row Electric SUV

Toyota will add 340 jobs at its Princeton, Ind. plant for a new electric SUV.

Sign up for the Design News Daily newsletter.

.jpg?width=300&auto=webp&quality=80&disable=upscale)