Lead-Acid vs Lithium Ion Batteries: Which will Win?

Both battery technologies are beginning to compete more heavily in select overlapping markets.

July 8, 2020

Almost everywhere you look there is news about improvements in lithium-based batteries and storage technologies. But what about traditional lead-based batteries? Are they a dying energy storage source? To answer that question, let’s take a look at trends in each market and the overlapping market space for each.

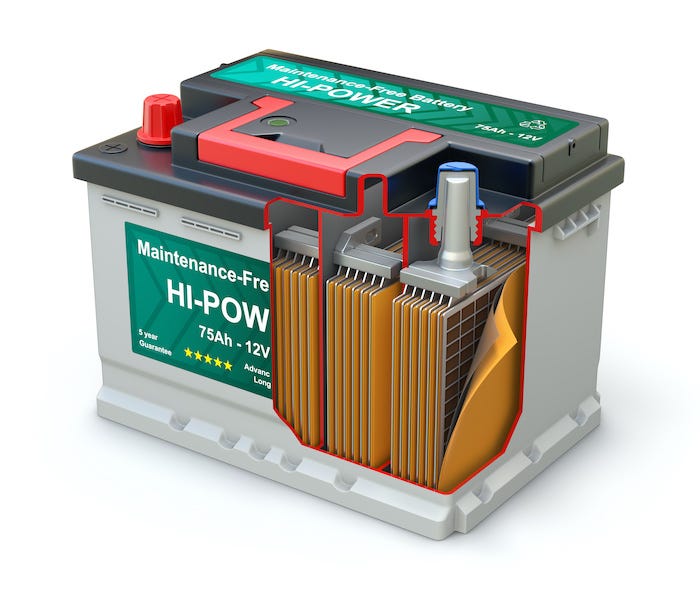

The lead-acid battery is the earliest type of rechargeable battery. Potential energy is stored chemically in an aqueous sulphuric acid bath as the potential difference between the pure lead at the negative side and the PbO2 on the positive side. Despite having a very low energy-to-weight ratio and a low energy-to-volume ratio, a lead-acid battery can supply high surge currents. This results in a relatively large power-to-weight ratio, which makes them ideally suited for use in motor vehicles to provide high currents required by starter motors. Plus lead-acid batteries are relatively inexpensive.

As the main energy source in motive, stationary, automotive, industrial and current grid energy storage systems, sales of lead-acid batteries are set to climb in passenger vehicles, electric vehicles and two-wheelers note a recent market study by Future Market Insights (FMI). The report predicts that the lead-acid battery market should surpass US$116.60Bn by the end of 2030. Further, the study estimates that demand for lead-acid batteries will be upheld by a transportation sector that is slated to grow 1.4x through 2029

While 2020 looks to be a modest market for lead-acid batteries, market vendors are pushing into the e-bikes markets. Further, thanks to high crank characteristics, AGM batteries are witnessing high demand growth in off-grid applications where charge rates are relatively lower and high autonomy is preferred. AGM stands for "Absorbent Glass Mat", which is a type of separator used in batteries. AGM batteries have a relatively small amount of acid, which is absorbed by the AGM separator. This allows the battery to be spill-proof and better suited for e-bikes and off-grid energy storage.

“Stationary energy storage has enormous near-term potential. Businesses such as battery manufacturers, grid operators are set to establish collaborative relationships with solar power developers and energy service companies”, says the FMI Analyst in its press release. For instance, Furakawa Battery Co Ltd has signed an agreement with I-WIND for the supply of batteries to be used in a wind power generation project.

The ongoing COVID-19 pandemic will impact the lead-acid battery market in the near term. According to the FMI report, the end of first quarter of 2020 saw lead acid battery demand slowly climbing up as containment strategies in China started to take effect and lockdown restrictions were lifted. Relatedly, consumer demand for major automotive and industrial manufacturing has fallen due to the pandemic.

The long term forecast for acid-lead batteries looks solid with reasonably strong growth predicted in the years ahead. Buyer sentiment will show reluctance towards new cars, however replacement batteries will keep up the demand.

|

Cross section of car battery with abstract label. (Image Source: Lead Battery Cross Section Adobe Stock) |

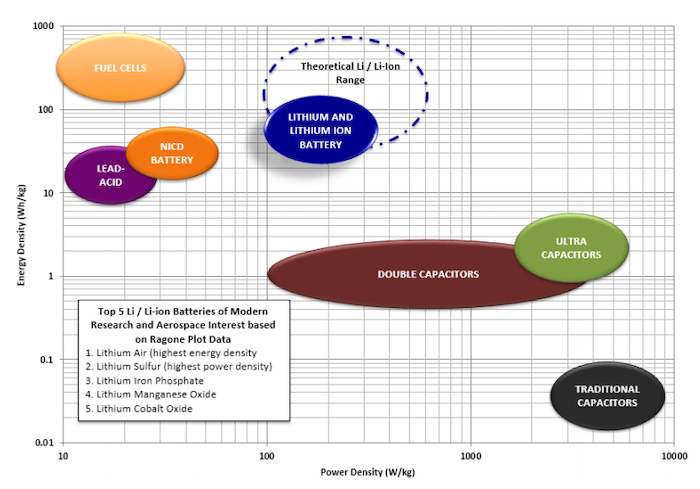

Now let’s consider the other type of battery. Lithium (Li) ion technology is still the preferred way to reach a high specific energy goal, as shown in the Ragone plot that compares the energy density of various devices. The chart plots values of specific energy (in W·h/kg) versus specific power (in W/kg). Both axes are logarithmic, which allows comparing performance of very different devices. For reference, lead-acid batteries are still typically used in gas powered commercial vehicles while lithium-ion batteries are associated with portable electronics such as laptops and mobile phones.

|

Ragone Energy Plot. (Image Source: NASA Ragone Energy Plot) |

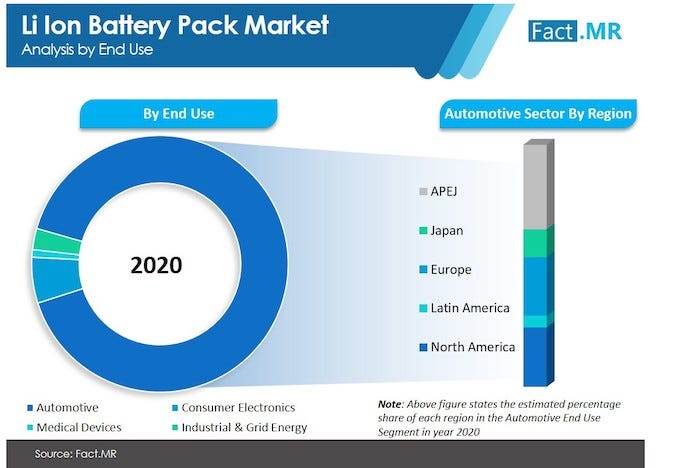

According to Fact.MR, the global Li-Ion battery pack market was valued at US$ 57.4 billion in 2020 and is expected to add value worth US$ 3.3 billion during the forecast period. The market is anticipated to expand at a CAGR of 2.7%. Lithium cobalt oxide battery type will hold the maximum share in terms of value, at US$ 64.4 billion by the end of the forecast period (2020 – 2030).

Automotive end use sector (e.g., for electric vehicles (EV)) is anticipated to hold more than 89% market share, creating an absolute $ opportunity of more than US$ 15.2 billion during forecast period.

On the down side, the report notes that amidst the COVID-19 pandemic, the market is poised to stagnate for the next couple of financial quarters. This is attributed to a significant drop in the demand for Li-ion battery packs globally. The adoption is expected to remain low as stringent lockdowns amidst COVID-19 has created exceptional slow-downs in industries such as consumer electronics, and automotive industry.

“The global outbreak of COVID-19 will hamper the expansion of li-ion battery pack market for next couple of financial quarters. As the key end use businesses start operating on maximum capacity, the market will regain traction through 2030,” says a Fact.MR analyst.

|

Trends in Lithium Ion battery pack market. (Image Source: Lithium Ion Battery Pack, Fact.MR) |

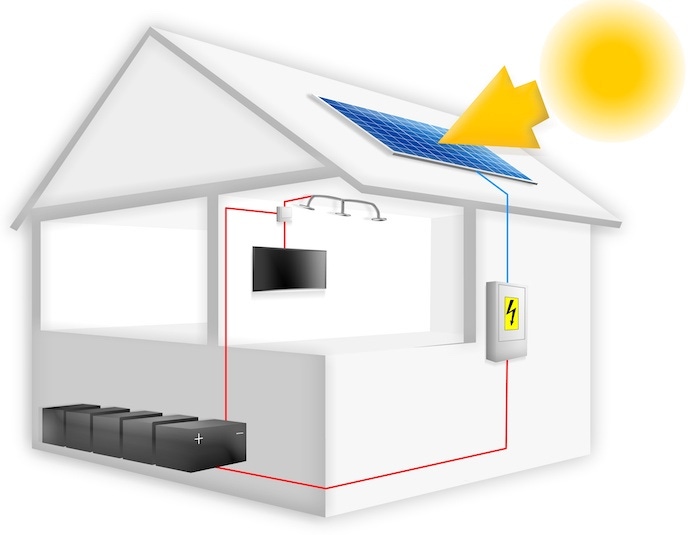

As shown earlier in the Ragone Energy Plot, lead-acid and lithium ion batteries operate in distinctive markets – for the most part. One area of cross-over is in the renewable energy storage space especially for off grid energy systems.

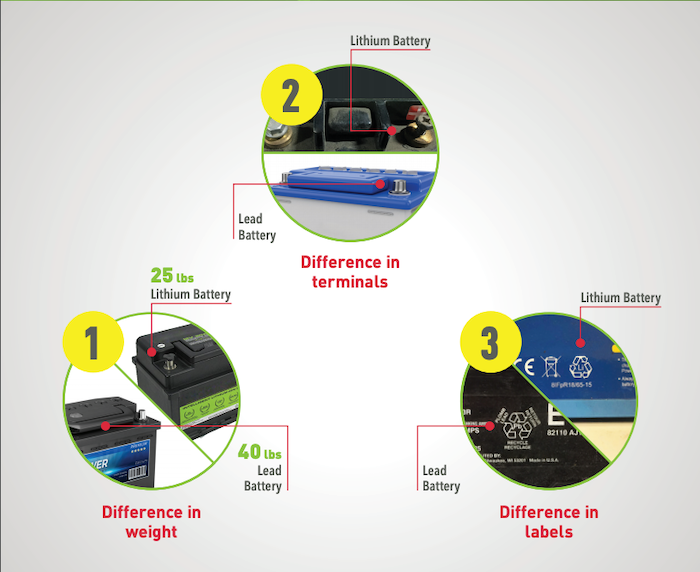

As a rule of thumb, lead-acid batteries cost less up front, but are limited with a shorter lifespan and require regular maintenance. In contrast, Lithium batteries are much more expensive up front, but they are maintenance-free and have a longer lifespan. This is why some experts in the renewable energy space predict the eventual end of lead-acid batteries as storage devices for solar and wind.

However, lead-acid battery technology has been improving. For example, the high cranking characteristics of Absorbant Glass Mat (AGM) – a type of lead-acid technology - batteries has resulted in significant demand in off-grid applications where charge rates are relatively lower and high autonomy is preferred.

Will such improvements be enough to challenge Lithium ion for off-grid applications? Other considerations are also important. For example, the Battery Council International (BCI) recently released a study showing lead batteries have a recycling rate of 99.3 percent, making them the No. 1 recycled consumer product in the U.S. Conversely, lithium-ion batteries are recycled at a rate below 5%.

On the economic side, the price of lithium ion batteries is steadily declining while the cost of lead-acid batteries remains relatively the same.

Another considerations is the supply chain. The U.S. State Department’s Energy Resource Governance Initiative notes that over 80% of the global supply chain of rare earth elements, important minerals for electric vehicles and wind turbine components, is controlled by China. The Asian has recently giant secured lithium mining operations globally to meet its demand for EVs.

In the final analysis, it may be that both battery and energy stories technologies will continue to serve the markets for which they are best suited. Ultimately, the market place will decide with technology is best suited for their needs.

|

How to properly identify a lead battery from a lithium battery. (Image Source: Battery Council Intern poster) |

John Blyler is a Design News senior editor, covering the electronics and advanced manufacturing spaces. With a BS in Engineering Physics and an MS in Electrical Engineering, he has years of hardware-software-network systems experience as an editor and engineer within the advanced manufacturing, IoT and semiconductor industries. John has co-authored books related to system engineering and electronics for IEEE, Wiley, and Elsevier.

About the Author(s)

You May Also Like