Bunny Suits Help, but Semi Fabs not Fully Immune to Coronavirus Economics

Semiconductor fabs remained open during the last crisis but supply chain disruptions a threat.

April 14, 2020

Few places are better protected from the spread of coronavirus than a semiconductor wafer cleanroom where everyone wears a full “bunny" suit. That’s why semi fabs now take advantage of their clean room areas to conduct most of their operational meetings instead of using ordinary conference rooms.

Semiconductor fabs like GlobalFoundries, SMIC, TSMC, UMC and others learned how to stay working and fabricate chips during the previous outbreak of coronavirus SARS-CoV. The lesson’s learned included working from home, greatly restricting travel, screening for fevers and similar actions.

In addition to being inherently clean, semiconductor fabs are also highly automated, which further lessens the spread of disease. Thus, even the XMC fab in Wuhan itself – the center of the coronavirus crisis in China – kept production running at normal levels.

Early in the current outbreak, it was hoped that the semiconductor industry would dodge the coronavirus (SARS-CoV-2) bullet – in part thanks to the earlier proven procedures and the cleanliness of the wafer fab. The continuing operation of semiconductor fabs during the crisis was predicted in mid-February 2020 by Omdia – an Informa owed technology research business. However, the reseachers cautioned that the semiconductor’s success would suffer repercussions if the outbreak slowed or suspended production among electronic manufactures.

|

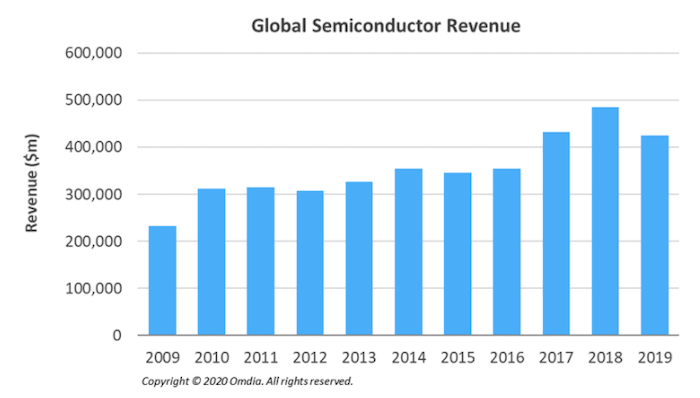

Image Source: Omdia |

Concern for the semiconductor industry is understandable as it represents a huge component of the global economy, generating an estimated $424.8 billion in revenue in 2019 alone, as reported by Omdia. Thus, suspended production or other potential disruptions to chip production would have major ramifications for worldwide economic growth.

One such issue is the disruption of the global supply chain. A recent analysis from Juniper Research reported that Coronavirus could cause around a $42 billion revenue gap over the next 9 months for smart device vendors. The analysis examined a number of key device verticals including smartphones, tablets, consumer robotics, smart speakers and smart wearables.

In the report’s high impact scenario (one of three considered scenarios), the forecast estimated a reduction in output of over 80 million devices over the next 9 months. Delays to the delivery of components, such as batteries, processors, and displays, would each have the potential to disrupt production rates from device vendors - including Apple, Samsung, Amazon, Xiaomi and Huawei. It was advised that all of these OEMs should ensure that any gaps in their supply chains are closed in order to meet the demand for their devices.

|

Image Source: Wikimedia / By Dorothyboyd, CC BY-SA 3.0, |

Such a risk to the supply chain is why the semiconductor industry is trying to obtain an “essential” status from the US government as well as a portion of the $2T US stimulus package.

The Semiconductor Industry Association (SIA) has asked the US government to designate the industry as an “essential business” allowing companies to continue to operate in spite of shutdowns. According to their website, SIA represents U.S. leadership in semiconductor manufacturing, design, and research, with members accounting for approximately 95 percent of U.S. semiconductor sales. Additionally, the SIA recently issued a statement calling on nations to prioritize semiconductor operations as they craft public health measures to battle the COVID-19 pandemic. The statement calls on governments to specify semiconductor and supply chain operations as “essential infrastructure” and/or “essential business” to ensure continuity of operations in the face of government lockdowns, shelter-in-place orders, or other restrictions on the movement of people.

The statement highlights the essential nature of semiconductors as key components for infrastructure and life-critical equipment such as health care and medical devices, water systems and the energy grid, transportation and communication networks, and the financial system.

Indeed, the semiconductor supply chain vendors are playing an important role in supplying critical supplies and technology to help fight the coronavirus. For example, Intel has promised to source and donate more than 1 million items of personal protective equipment – masks, gloves and other gear – to healthcare workers. In addition, the Intel Foundation will provide $4 million to support coronavirus relief efforts.

Electronic Design Automation (EDA) tool giant NVIDIA is providing COVID-19 researchers free access to Parabricks for 90 days. The genome-sequencing software for GPUs accelerates the learning process to understanding the coronavirus.

Wright Williams & Kelly, Inc. (WWK) a leader in Cloud-based cost and productivity management software and consulting services is offering access to its software platforms at cost to any organization shifting production to help fight the COVID-19 virus.

Although the semiconductor market remains a relative bright spot in the global marketplace, it is not immune. Over the last few weeks, several fabs have had at least one employee who has tested positive for coronavirus, including Samsung and TSMC. It seems that no industry can fully escape the spreading viral crisis but the semiconductor supply chain has proven more flexible and resilient than most other businesses.

|

Image Source: Adobe Stock |

RELATED ARTICLES:

John Blyler is a Design News senior editor, covering the electronics and advanced manufacturing spaces. With a BS in Engineering Physics and an MS in Electrical Engineering, he has years of hardware-software-network systems experience as an editor and engineer within the advanced manufacturing, IoT and semiconductor industries. John has co-authored books related to system engineering and electronics for IEEE, Wiley, and Elsevier.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)