Report: Solar-Energy Storage Market to Grow to $8 Billion by 2026

A recent report from Lux Research is predicting the market for energy storage for solar-energy systems to grow to $8 billion by 2026.

February 4, 2016

Researchers have been working for some time to develop reliable and cost-effective storage for solar energy as a key driver to support the growth of this type of renewable for residents, businesses and as part of the global energy grid. Their efforts seem to be working, as a recent report from Lux Research is predicting the market for energy storage for solar-energy systems to grow to $8 billion by 2026.

The report , “Helping Renewables Shine On: Analyzing the New Business Cases Where Batteries Make Sense for Solar Systems,” found that not only will the market for solar energy storage grow, it also will have an affect on the solar energy industry and begin to merge solar production and solar storage, what until now have been separate markets, said Cosmin Laslau, Lux research senior analyst and lead author of the report.

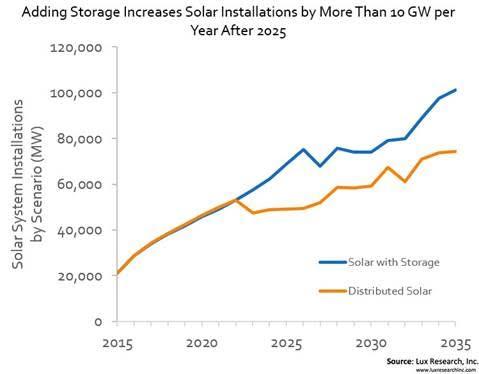

A chart from a report by Lux Research shows the expected growth in the solar energy storage market in the next 10 years, when it is expected to reach $8 billion worldwide.

(Source: Lux Research)

$8 billion represents the global opportunity for storage paired with distributed solar installations, Tyler Ogden, a Lux analyst and co-author of the report, told Design News in an interview. It amounts to a compound annual growth rate of 27% from 2015 to 2026. Energy storage will increase the distributed solar market by 25 GW annually in 2026.

Two trends are driving this growth, Ogden said. Policies that made it more attractive for people to sell solar energy back to the grid than to use it themselves are being scaled back, encouraging people to want to use the energy more at home, which requires storage, he said. The cost of storage also is declining, he told us, making it more affordable.

[Learn more electronics trends and developments at Pacific Design & Manufacturing, Feb. 9-11, at the Anaheim Convention Center.]

“Currently, the cost of installing a storage system alongside a solar array is high, restricting it to a few attractive markets or as an expensive add-on feature,” Ogden said. “However, the costs of storage will decline, improving the business case to install a solar-plus-storage system. This will particularly be seen as companies evolve their business model to offer solar-plus-storage systems outright.”

Solar-energy storage has been a thorn in the side of the broad adoption of this technology as part of the energy spectrum in the United States. But that’s changing as the solar industry is beginning to focus their efforts and real options for storage are beginning to emerge that also will change how the market looks in the next few years, according to the report. Congress also recently passed an extension to an important tax credit for solar installations, further bolstering the market.

Another reason for the growth in solar storage is that partnerships are beginning to emerge between stakeholders to make it more convenient and viable, but that also, incidentally, bring together companies from the separate solar energy and solar storage industries, analysts said. This is how the solar energy production and storage markets will begin to become more vertical, Ogden and Laslau wrote in the report.

One key partnership cited in the report is with First Solar, a developer of thin-film solar panels for utility-scale installations. The company is part of a consortium that invested $50 million in energy storage software developer Younicos, a leader in grid-scale energy storage integration.

READ MORE ARTICLES ON SOLAR ENERGY:

Younico’s software and controls are battery-agnostic, which means neither company is being restricted to support only one type of solar-energy storage as the leading solution, analysts wrote. More importantly, the deal shows the move toward the integration of solar-plus-storage systems.

Software is also another trend that’s driving the market and the integration of the two previously separate industries. Market leaders like SolarCity and others are offering demand-management software that can help integrate storage.

Meanwhile, other companies are offering different types of valued-added software, analysts said. Sunverge Energy has a system that can link to smart devices and electric vehicles, while software from German utility company Sonnen can analyze weather data to optimize solar consumption and storage. All of these show the solar market maturing and making much more complete offerings available to support the growth of the storage space, analysts said.

Elizabeth Montalbano is a freelance writer who has written about technology and culture for more than 15 years. She has lived and worked as a professional journalist in Phoenix, San Francisco, and New York City. In her free time she enjoys surfing, traveling, music, yoga, and cooking. She currently resides in a village on the southwest coast of Portugal.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)