Growing Future for Metal Injection Molding

December 14, 2012

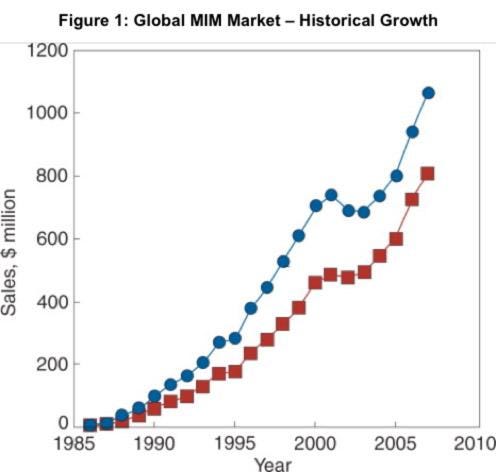

Metal injection molding (MIM) is experiencing a worldwide boom, with an estimated market worldwide of more than $1 billion per year, and compound annual growth rates estimated to be as high as 20 percent. This booming demand for MIM is primarily attributed to the technology's significant cost savings compared to the use of machining or electrical discharge machining. Growth drivers, especially those resulting from medical and firearms industry trends, means that strong MIM technical players are in a good position to bring significant value to customers.

MIM technology is used to form a near net-shape metal part by consolidating metal powder in a special sintering process. The lack of raw material waste, as well as reduced cycle times, can reduce costs by more than 50 percent. While the technology suffered from a shaky technology de-bugging period between its launch in 1970s and the new millennium, several players have now advanced MIM technology to the point that it is currently seen as a strong and reliable solution for overcoming several important economic challenges.

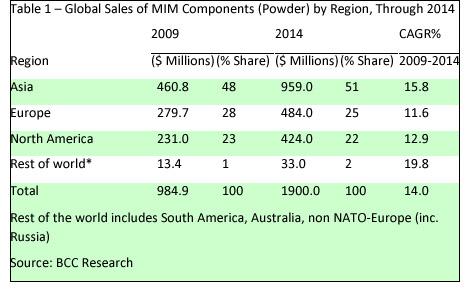

The explosive growth rates have been escalating as the technology receives increasing acceptance for high volume-manufacturing of tightly toleranced small metal components. The American MIM market is estimated at $250 million, with 40 manufacturers in contract manufacturing and more than 10 original equipment manufacturers (OEMs) running captive operations. European demand is approximately $350 million, while the market in Asia, with China leading the growth, is approximately $550 million.

Firearms and medical segments see MIM as attractive option

Firearms and medical applications are the two main segments of MIM demand. Firearms OEMs made the transition to broad sourcing in MIM more than a decade ago, and continue to have growing interest in containing costs and expanding production. Despite (some say because of), the recent economic downturn, the US firearms industry has grown, and background checks for gun sales reached a record high in 2011. Domestic MIM players have a significant advantage over international players in firearms due to ITAR regulations, and those with an ability to respond to the recent ramp up in firearms demand have made significant strides in organic growth.

For example, Parmatech Corp.'s unique MIM capabilities give manufacturers the ability to make weapons from a range of materials using the same tooling, a feature not possible with casting or forging. Parmatech offers a MIM process that can use 4140 and MIM-4605 carbon steel, and 17-4 and 420 stainless steel, all with the same tooling.

By using this MIM process, firearms manufacturers can form several separate parts into one, consolidating a weapon's mechanical components and reducing the component count. This significantly reduces development time and effort and improves supplier tracking. Producing multiple component parts that operate smoothly together is key to the modern firearms manufacturer. As modern weapon manufacturers design sophisticated firearms with numerous interlocking moving parts, they are turning to MIM to produce high volumes of components that can be assembled together without the need for costly machining and gunsmithing.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)