US Manufacturing Roars Back in 2022

Good news on Manufacturing Day – US production is up via organic growth, government initiatives, and reshoring.

October 6, 2022

National Manufacturing Day takes place on the first Friday of October. During this day, manufacturers open their doors to showcase modern manufacturing and encourage interest in manufacturing careers. All across the US, manufacturers show the public what manufacturing looks like through more than 2,600 open houses and events in each of the 50 states and Puerto Rico. An estimated 400,000+ students, parents, and community members attend National Manufacturing Day events.

2022 has been a strong year for manufacturers. Despite turbulence brought on by the pandemic, US manufacturing is building back strong, undeterred by significant labor and supply chain challenges.

Cautious Optimism

The 2022 outlook by Deloitte reveals positive manufacturing trends. Yet optimism around revenue growth is held in check by caution from ongoing risks. Workforce shortages and supply chain instability are reducing operational efficiency and profit margins. Business agility is critical for manufacturers during this uncertain time. Leaders are turning to smart technology implementations and innovation to defend against disruption and strengthen their way forward.

Deloitte notes that manufacturers are remaking supply chains for advantage beyond the next disruption. Supply chain challenges are acute and still unfolding. There’s no mistaking that manufacturers face near-continuous disruptions globally that add costs and test abilities to adapt. Purchasing manager reports continue to reveal systemwide complications from high demand, rising costs of raw materials and freight, and slow deliveries in the US.

Transportation challenges are likely to continue through 2022, including driver shortages in trucking and congestion at US container ports. As demand outpaces supply, higher costs are more likely to be passed on to customers. Yet analysts remain bullish about US manufacturers' ability to grow through these uncertainties. Some are bringing manufacturing home while others are taking advantage of government programs that encourage domestic production.

Reshoring Is Gaining Traction

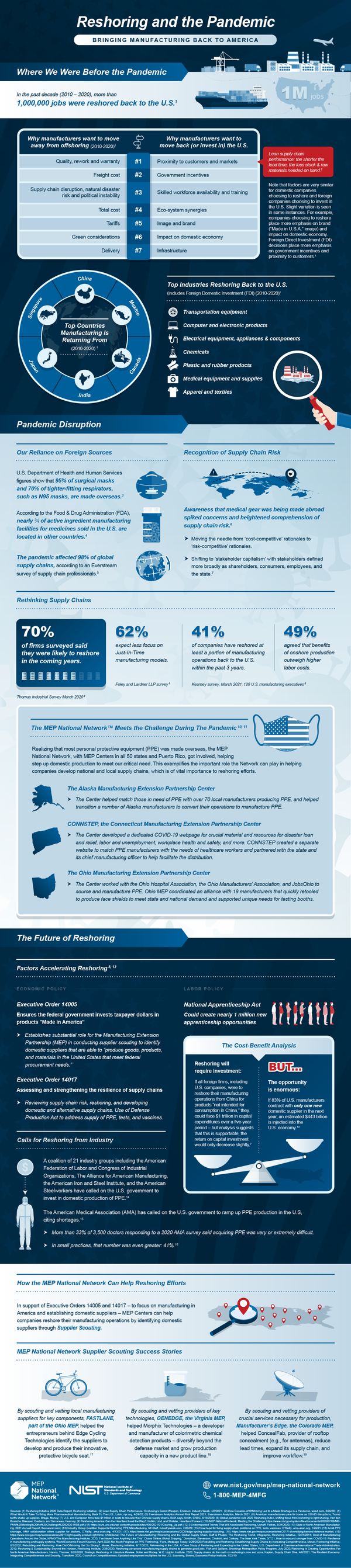

According to a report from the National Institute of Standards and Technology, the reshoring of manufacturing back to the US has been top of mind for many manufacturers, especially in light of the supply chain issues brought on by the pandemic. Proximity to customers and markets, eco-system synergies, and the impact on the domestic economy are all reasons why manufacturers want to move production back to the US.

The following infographic from NIST shows the story of reshoring in the US:

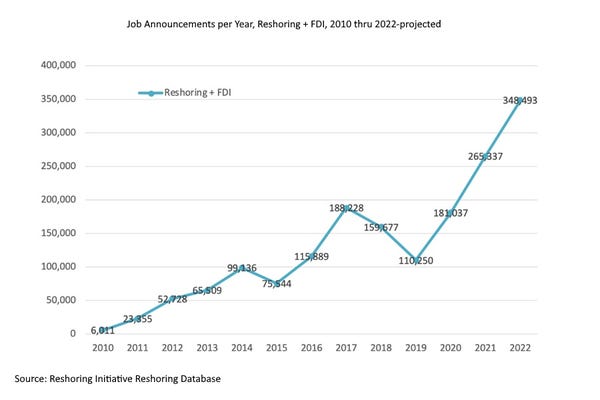

According to a report from the Reshoring Initiative, In 2021 the private and federal push for a domestic supply of essential goods propelled reshoring and foreign direct investment (FDI) job announcements to a record high. Data from the first half of 2022 shows reshoring and FDI continuing these gains. The current 2022 projection of jobs announced is around 350,000, another record, up from 260,000 in 2021. If the projection is achieved, 2022 will bring the total number of jobs announced since 2010 to over 1.6 million.

Supply chain gaps and the need for greater self-sufficiency continue as major factors driving reshoring. The possibility of a Taiwan-China conflict and the threat of China decoupling focus on those concerns. The destabilizing geopolitical and climate has brought to light vulnerabilities and the need to address them. Subsequently, great opportunities have arisen for a continued meaningful rebound of US manufacturing. The report concludes that continuing the current trajectory will reduce the deficit, add jobs, and make the US safer, more self-reliant, and resilient

The Reshoring Initiative notes that the acceleration of jobs coming back to the US combined with the decline in the rate of offshoring has resulted in a 12-year steady uptrend in US manufacturing jobs. The COVID crisis has revealed North America’s over-dependence on imports. That combined with the Ukraine/Russian war and geo-political tension with China will drive ongoing supply chain shifts, further accelerating reshoring and nearshoring.

About the Author(s)

You May Also Like