For MEMS Businesses, It’s All About ‘Show Me the Money’

July 7, 2015

Which of those famous movie quotes best describes the current state of the MEMS and sensors industry? From my perch as executive director of MEMS Industry Group (MIG) -- the trade association advancing MEMS and sensors across global markets -- today's environment is typified by both.

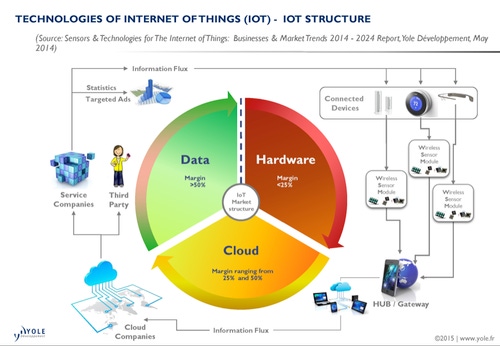

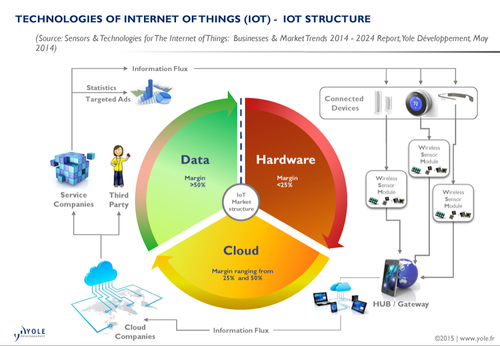

Why? I recently bumped into an image courtesy of Yole Development. The image shows the "pie" of Internet of Things technologies and where the margins are -- in other words, who is making the money. It looks like relatively bad news for those that are focused only on hardware. Although they represent a third of the pie in terms of quantity, they are making less than 25% of the margin. Most of the margin goes to data (read: data analytics), followed closely by "the cloud," which is conveying the data from hardware.

So what's the MEMS/sensors industry -- which is mainly focused on hardware, the chips that are the bedrock of IoT -- to do in this landscape? Go big or go home.

That might explain the recent surge in mergers and acquisitions in the industry. I spoke with John Chong, vice president of product and business development at MEMS systems maker Kionix, who said, "Even though hardware is integral, because it delivers in high volumes and is mostly interchangeable, it has extremely low margins. Since software is smaller volumes and mostly custom, it enjoys higher margins."

In other words, it's time to make friends upstream, my hardware friends. Member companies of MIG are swimming together in a pool of companies that represent this possibility of vertical integration. One way to address end-to-end challenges is to acquire or merge/partner with companies that can do what you don't. MIG members have a leg up by the nature of their inclusion in the trade group's network of supply chain companies.

MORE FROM DESIGN NEWS: Bosch Sees Huge Uptake in MEMS as IoT Thrives in Consumer and Industrial

Vertical integration is not a new idea. In fact, in a 2010 interview, Benedetto Vigna, executive vice president and general manager of the Analog, MEMS & Sensors Group at STMicroelectronics, described MEMS "traps" -- ways of thinking about MEMS that he felt were holding the industry back and slowing its growth. He advised those working in MEMS to avoid "falling in love with the chip" or the technology; instead, he recommended that the industry fall in love with applications. This is very much in line with how ST works today, diversifying its products in market segments, as well as applications and partnering/collaborating with (as well as acquiring) other companies to meet market demands.

But still the issue remains: Who will make the money upstream, from the applications? It will be companies that can provide end-to-end solutions with a combination of hardware and software. Companies that can take things from hardware/chip, to software, to cloud, to data analytics are best positioned to maximize their margins.

Which are those companies in the hardware space? Companies like GE and Bosch, which are working on end-to-end solutions, like GE's sensor-laden jet engines that provide airlines with to anticipate maintenance of their airplanes and save millions of dollars. Bosch is making a big investment in smart homes, partnering with ABB and Cisco in a joint venture that is developing and operating an open software platform for smart home devices and applications.

MORE FROM DESIGN NEWS: What's Your MEMS Story?

But that's not to say the money is only to be made by the big behemoths; there's plenty of room for innovative companies and startups that are utilizing hardware and software, as well as the analytics. Part of the reason why MIG launched Acceleration Innovation Community (AIC), the trade group's open-source algorithm library, is to meet this growing need for collaboration of hardware and software. AIC is a growing repository of sensor fusion software -- a starter kit for those swimming upstream toward the application world, looking to make their products more powerful and energy-efficient.

An example of a nimble startup company that is making a play for the rich analytics that smart MEMS and sensors create is Humanyze, a MIT Media Lab spinout. Ben Waber, Humanyze co-founder, president, and CEO, recently spoke at MIG's MEMS Technical Congress about how the company is combining wearable sensors and digital data to deliver people analytics and insights for its customers, which range from the Sacramento Kings basketball team to Bank of America.

Humanyze has created a sensor-laden ID badge (it calls the device a "sociometric badge") that tracks how employees talk to each other, who talks with whom, how they move around the office, and where they spend their time. Humanyze's research has huge implications for the future of work and workspace design, and this is just the tip of the iceberg of what the combination of sensors with data analytics can reveal and revolutionize.

For hardware companies that are positioned well -- by diversifying their product lines, partnering, and innovating -- the outlook is akin to "everything is awesome." But for those that are in the MEMS business, we know it's not easy. To get to a trillion sensors in the IoT that we all look forward to, there are many challenges to commercialization that still remain, including interoperability, the lack of standards, and the issue of security, to name a few.

So perhaps it's time to channel another quote, from the guru of end-to-end solutions: the late Steve Jobs. When he introduced the iPhone in 2007, he famously quoted Alan Kay: "People who are really serious about software should make their own hardware." Well said.

Karen Lightman is executive director of MEMS Industry Group (MIG) , the trade association comprising more than 160 companies advancing MEMS and sensors across global markets.

About the Author(s)

You May Also Like