Weak PC and Server Market Drags Down Electronics Supplier Earnings

While second-half pickup is forecast, near-term outlook remains tepid as suppliers navigate through weak end markets.

First-quarter electronics supplier earnings were, as expected, somewhat lackluster due to weak market conditions. But not all suppliers had bad quarters. Companies whose end markets included a heavy dose of industrial and automotive customers fared better, while those in the PC and server markets did notꟷindicative of how those markets have fallen over the past year.

Some of the dire results came from AMD, and as announced previously, Intel and Samsung. The weak PC and server markets have in particular been devastating to Intel, and earlier this week the troubled semiconductor supplier reportedly said it would lay off more workers. Although details on which business units or locations were not given, some analysts speculate that the company’s troubled client computing and data center units would be among those affected.

Intel’s main rival, AMD, did not emerge from the first quarter unscathed either, though its situation is at this point not as dire as Intel. AMD’s results and more electronics supplier earnings follow below.

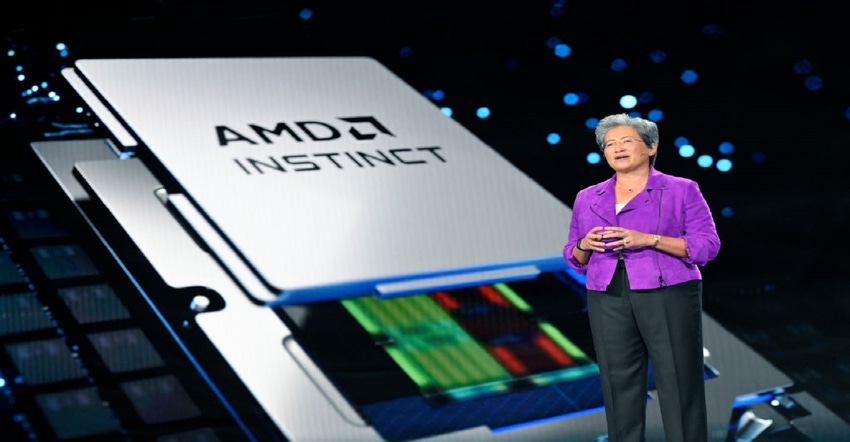

Weak Server Market Dooms AMD

Like Intel, AMD’s first-quarter results were affected by a weak PC and server market. The semiconductor supplier recorded first quarter revenue of $5.4 billion, gross margin of 44%, operating loss of $145 million, a net loss of $139 million and diluted loss per share of $0.09. On a non-GAAP basis, gross margin was 50%, operating income was $1.1 billion, net income was $970 million and diluted earnings per share was $0.60.

In the year-ago quarter, AMD posted revenue of $5.8 billion, gross margin of 48%, an operating income of $951 million, net income of $786 million, and diluted earnings per share of 56 cents.

AMD Chairperson and CEO Lisa Su said she expects the PC and server market to improve the second half of 2023. For the second quarter of 2023, AMD expects revenue to be approximately $5.3 billion, plus or minus $300 million. AMD expects non-GAAP gross margin to be approximately 50%.

Automotive Bright Spot in Lackluster Q1 for Ti

Semiconductor supplier Texas Instruments (TI) posted first-quarter revenue of $4.38 billion, net income of $171 billion, and earnings per share of $1.85, all down from the year-ago quarter when TI posted sales of $4.9 billion, net income of $2.56 billion, and earnings per share of $2.35.

TI President and CEO Haviv Ilan attributed the lower sales and earnings to weaknesses in the company’s end markets, except for automotive.

The company is projected second-quarter revenue of $4.17 to $4.53 billion and earnings per share between $1.62 and $1.88.

ST Micro Beats Guidance on Strong Automotive, Industrial Sales

ST reported first quarter net revenues of $4.25 billion, gross margin of 49.7%, operating margin of 28.3%, and net income of $1.04 billion or $1.10 diluted earnings per share. Compared to the year-ago quarter, ST saw its revenue increase 19.8% and net income rise 39.8%.

According to Jean-Marc Chery, STMicroelectronics President & CEO, the company reported strong revenue in its automotive and industrial markets, partially offset by lower revenue in personal electronics. Chery also noted that the gross margin was 170 basis points above the mid-point of its business outlook range mainly due to product mix in a price environment that remained favorable.

For the second quarter, ST projects net revenues of $4.28 billion, increasing year-over-year by 11.5% and increasing sequentially by 0.8%. Gross margin is expected to be about 49.0%.

TE Posts Strong Sales from Industrial, Transportation

Components and connectivity supplier TE Connectivity reported a stronger-than-expected first quarter sales, buoyed by strong sales in its industrial and transportation markets.

TE posted net sales of $4.16 billion, which were up slightly from $4.0 billion in the same quarter a year ago. Net earnings were $433 million or $1.37 per share, down from $560 million, or $1.72 per share a year ago.

According to the company, revenue grew by 12% in its Transportation Solutions and 15% in its Industrial Solutions segments respectively, offset somewhat by a 20% decline in its Communications Solutions segment.

For its current quarter, TE Connectivity is net sales of approximately $4.0 billion. GAAP earnings per share from continuing operations are expected to be approximately $1.56, with adjusted EPS of approximately $1.65.

Amphenol Posts Good Quarter But Expects Weaker Q2

Connector and components supplier Amphenol Corporation posted first-quarter sales of $2.97 billion, up slightly from $2.95 billion in the year-ago quarter, with earnings of $442.7 million, compared to $429.2 million a year ago. The company said sales were strong in its commercial air, broadband communications, military, industrial, and automotive markets, though sales declined in its IT datacom, mobile networks, and mobile devices markets.

For the second quarter, Amphenol is forecasting to range from $2.890 billion to $2.950 billion. This represents a 6% to 8% decline over the prior year quarter. Adjusted Diluted EPS is expected to be in the range of $0.66 to $0.68, representing a 9% to 12% decline over the second quarter of 2022.

Arrow Meets Guidance on Lower Sales and Earnings

Electronic components distributor Arrow Electronics reported first-quarter 2023 sales of $8.74 billion, down 4% year over year. First-quarter net income was $274 million, or $4.60 per diluted share, compared with net income of $365 million, or $5.31 per share on a diluted basis, in the first quarter of 2022. Both revenue and earnings per share exceeded the midpoint of the company’s guidance.

Arrow said sales in its U.S. and Asia-Pacific markets declined 5% and 19& year-over-year respectively, while sales in its European markets increased 17% year-over-year.

For its second quarter, Arrow is forecasting consolidated sales of $8.42 to $9.02 billion, with component sales of $6.64 to $7.04 billion, and global enterprise computing sales of $1.78 to $1.98 billion. Net earnings are pegged at $4.10 to $4.30 per share.

Avnet Meets Guidance on Slight Earnings Increase

Electronics component distributor Avnet posted first-quarter 2023 sales of $6.51 billion, up slightly from $6.48 billion in the same quarter a year ago. Net earnings were $2.03 per diluted share, up from $1.84 per share a year ago.

Operating margin in Avnet’s Electronic Components sector was 5.0%, up 64 basis points year-over-year.

For the current quarter, Avnet is projecting sales of $6.10 to $6.40 billion, with earnings per share of $1.60 to $1.70.

Spencer Chin is a Senior Editor for Design News covering the electronics beat. He has many years of experience covering developments in components, semiconductors, subsystems, power, and other facets of electronics from both a business/supply-chain and technology perspective. He can be reached at [email protected].

About the Author(s)

You May Also Like