Industry Voices: Automakers Face Big Challenges and Opportunities in 2024

For automakers, worker shortages persist. Revenue from maintenance is shrinking. Innovation is a must.

January 3, 2024

At a Glance

- Worker shortages persist

- Maintenance revenue is shrinking

- Data becomes a revenue stream

The worker shortages in the automobile industry span everything from engineering and design to tooling and line workers. The issue has become global. The solution is forcing automakers to get innovative.

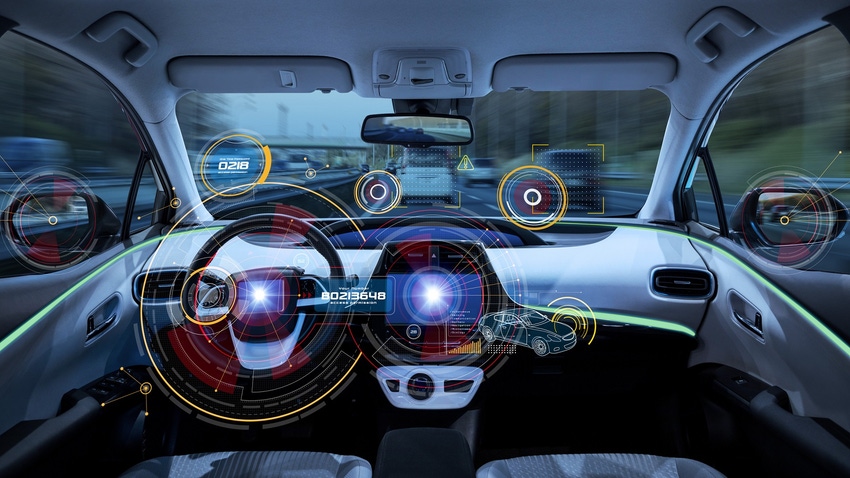

The industry is also experiencing a decline in revenue from maintenance and repair. Cars are well-made mechanically. They are also becoming rich data centers. Some automakers are looking to monetize the data connections in their vehicles. We caught up with Bill Newman, an industry executive advisor at SAP, to see what automakers are doing to face these challenges.

What major issues will automakers face in 2024?

Bill Newman: Worker shortages will be the big one. The automotive industry will experience a talent reckoning in 2024, forcing automakers to reconsider strategic priorities. As automakers look to meet ambitious electric vehicle production commitments in the coming year, workforce challenges will present as an obstacle to fulfillment. The talent shortage across the industry will continue to intensify as automotive companies compete with out-of-industry employers for the same resources.

Against this backdrop, 2024 will be the year when the automotive industry faces a talent reckoning, requiring them to adapt their organizational strategies. Instead of trying to do everything at once – from charge-point operations to battery recycling to software development – automakers will need to take a more targeted approach, prioritizing the areas that will give their company the most strategic advantage rather than spreading their talent thin.

Do you expect workforce issues to persist?

Bill Newman: It’s a global issue. We don’t have enough skilled labor and educated engineering talent. It’s a combination of the pandemic and people with long careers who are retiring. We’re seeing a generation shift from five generations in the workforce down to three. Too few workers in tooling has been a major issue in design-build as far back as 2017. Now we’re seeing people who don’t know how to work a line. Plus, it’s difficult to get people to stay with the jobs. And then there are immigration issues. You have to be creative in L-1 Visa exchanges. Canada is ahead of us on immigration. We’re still behind.

Are automakers becoming innovative in dealing with worker shortages?

Bill Newman: As we go into 2024, different leaders are taking different paths. Some have looked to multi-ethnic groups who prefer to work third shifts. Several leaders are looking at the formerly incarcerated workforce. Some great people are taking on a new life and want a new trade. You have to find them. Automakers are using charter planes for design reviews. You have to be flexible with the workforce. This is an issue even in Europe.

Is there a way artificial intelligence can assist with workforce issues?

Bill Newman: AI can only do so much. Artificial intelligence and automation are the buzz. Generative AI will help, but you have to teach it. AI can’t keep a secret. It has a hard time decerning truth from fiction. Sometimes it takes a while for AI to learn. We use open responsible fenced-in AI. You have to teach it to use the knowledge as someone in your company would.

What are there ways automakers are increasing their revenue streams?

Bill Newman: As vehicles incorporate more sophisticated software and fewer mechanical components, they will require less frequent physical servicing, reducing the revenue opportunities from repairs and maintenance. To keep up with the evolving market, legacy automakers will need to adapt their business models. In 2024, they will need to explore opportunities to monetize the data generated by their vehicles and turn that into additional revenue streams. Through targeted data monetization, we will increasingly see auto companies innovating in exciting ways so they can stay competitive in this new era.

What are some examples of monetizing data?

Bill Newman: I’ve had three conversations recently about where you create revenue that’s not dependent on the sale of a new vehicle. One is in the area of fleet transportation as a service. When developing a long-term lease, you can push services over the air. And you can bill against those services. You can use AI to see what services customers might need.

You look at the 360 of the vehicles and see what the driver and operator need. Those provisions will change from vehicle to vehicle. We have one maturing EV start-up that is pushing new services to their vehicle owners every 30 days. What can we do beyond analytics to build AI? Mom goes to soccer practice, and Dad goes to the coast on weekends. We can feed them apparel choices, sometimes with a strong brand. Those are some of the cool things.

About the Author(s)

You May Also Like