2020 Auto Sales Forecast to Drop 22%, with Risk for Further Deterioration

Analysts trim their outlooks due to COVID-19; European electric vehicle registrations reach record high despite economic chaos; polypropylene compounds market to be severely impacted.

May 4, 2020

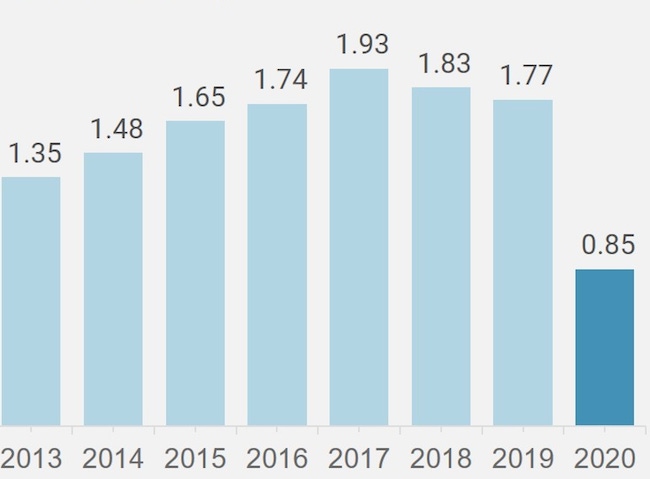

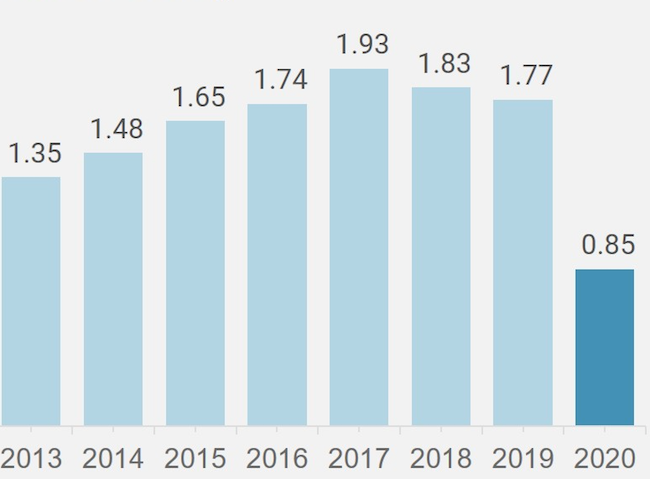

Global light vehicle sales are forecast to be 69.6 million units this year in the wake of the COVID-19 pandemic, according to market watcher IHS Markit, which is also forecasting a similar decline in global light vehicle production, to 69.3 million units. The world manufactured around 87.4 million light vehicles in 2019, according to the International Organization of Motor Vehicle Manufacturers, 20.7% higher than IHS Markit’s 2020 forecast.

IHS Markit says its current forecast could still yet have some downside. The implications for plastic compounds employed in automobiles are indeed severe, according to Dr. Liang Tao, Global Business Development Director at polyolefin market research firm Townsend Solutions. Based on modeling by Tao, around 900,000 tonnes of polypropylene (PP) consumption will be lost this year due to reduced vehicle production.

Tao also notes that new vehicle development programs, particularly in western countries, may be delayed at cash-strapped automakers, which could slow growth in wider use of plastic compounds in vehicles. There is also a fear that if low oil prices persist, consumer attraction to electric vehicles could be blunted.

|

Europe-27 new vehicle registrations plummeted 52% in March compared to March 2019. As a comparison, sales in March 2009, during the financial crisis, were down 9.6% year-on-year. Image courtesy of JATO Dynamics. |

Global vehicle sales for March 2020 were down 39% according to UK analyst JATO Dynamics. “This downward trend is not simply due to the restrictions of free movement. The industry is being impacted largely by the uncertainty for the future, and this issue started to arise even before the pandemic took hold,” said Felipe Munoz, JATO’s global analyst.

“We have to remember that the industry was already operating in a challenging environment, especially towards the end of last year," Munoz continued. "The trade wars, lower economic growth and tougher emissions regulations came long before the COVID-19 crisis. And unlike previous recessions, we’re not just dealing with people’s fears or purchase delays. This time we have to consider that consumers are simply unable to leave their homes.” Overall, sales for the first quarter of 2020 already highlighted a 26% reduction versus Q1 2019, with sales decreasing to 17.42 million units.

If there was a bright spot, sales of electric vehicles (EVs) in Europe increased 15% to 147,500 units in March, posting a new record market share of 17.4%, or 10.1 percentage points higher than seen in March 2019. This growth was not driven by Tesla, as in past years, but came as a result of more EVs from Mercedes (+44%), Volkswagen (+240%), BMW (+15%), Hyundai (+25%), Volvo (+79%), and Suzuki, among others.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)