China Grabs the Cobot Future

Already the largest robot producer, China will hold 50% of the cobot market in the next two years.

May 31, 2022

When you think industrial robots, you think Japan. When you think collaborative robots, you might think Europe. Think again, it’s China. According to Interact Analysis, China will own half the cobot market in the next two years.

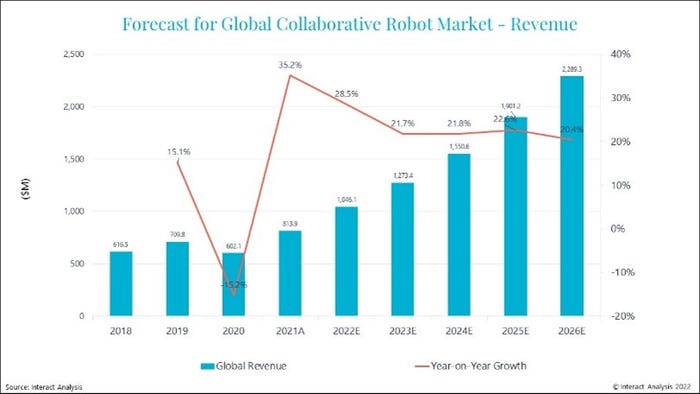

The Interact Analysis study reveals that cobot production grew by more than 40% in 2021. Cobots had become part of a post-pandemic rebound. The market for collaborative robots will continue to grow strongly through 2026 with annual growth rates staying over 20%. Logistics, manufacturing, and service industries are likely to be long-term growth drivers.

The Chinese market for collaborative robots continues to lead over Europe and North America. Interact Analysis predicts that China’s market share by shipments will increase from 49.1% in 2021 to 54.4% in 2026. At that point, annual unit shipments will exceed 50,000. China’s growth through 2026 will be 29% - the highest globally. In North America, the uptake of cobots –particularly in manufacturing – is much more cautious. It’s likely to retain the smallest market share overall. Yet it’s still an impressive 19.4% over the next five years.

China’s Five-Year Robot Production Plan

China’s robot growth is no accident. It’s in the government plan. China’s Ministry of Industry and Information Technology released a five-year plan on robotics in December that aimed for the country’s robot industry to grow at an average annual rate of 20 percent from 2021 to 2025.

China has been the world's largest market for industrial robots for the past eight years. Wang Weiming, an official with the ministry, said China aims to double its manufacturing robot density by 2025. High-end, advanced robots are expected to be used in more sectors such as the automobile, aerospace, railway transportation, logistics, and mining industries. Then there’s the cobot market.

By 2026 the collaborative robot market will be three times the size it was in 2021, exceeding $2 billion that year and with shipment rates exceeding 100,000 units. A key focus for cobot companies is making their products suitable for new application scenarios. Currently, we see a strong uptake in medical, education, logistics, and catering. Interact Analysis predicts greater uptake in manufacturing where cobots are helping to plug the gaps caused by ongoing labor shortages.

Labor Issues Drive Cobot Usage

Labor shortages are having a strong impact on cobot sales in In North America. “As we emerge from the COVID-19 pandemic, the issue of labor shortages is seemingly never-ending,” said Maya Xiao, Senior Analyst at Interact Analysis. “Our research shows that once one competitor invests in collaborative robots, and it is seen to work, there is a ripple effect.

Collaborative robots have become a big part of intelligent manufacturing and lean production. They’ve seen a spike in popularity over the past few years as part of the push towards automation in industry and constant downward pressure on costs. Xiao noted that “Collaborative robots are being used as a form of future-proofing because the pandemic creates so much uncertainty that companies don’t know what to expect next.”

About the Author(s)

You May Also Like