China's Rare Earth Export Cutbacks Raise Alarms

September 22, 2011

Prices for rare earth elements -- an important component in motors and other electromechanical products -- have jumped by at least an order of magnitude over the past year as a result of export cutbacks from China, the world's largest source of the elements. Alternative supplies promise to provide a surplus, but not as soon as manufacturers using this materials might like.

Rare earth elements such as neodymium (Nd) and dysprosium (Dy) play essential roles in products ranging from motors to white-light LEDs. Permanent magnets containing Nd typically produce magnetic fields five or more times as large as those produced by ferric magnets. The addition of Dy prevents them from demagnetizing at high temperatures. Those attributes make rare earth magnets highly appealing for motor applications.

However, in the past year or so, changes to export quotas by China have sent prices soaring, leaving motor designers in a fix. Solutions range from the old (ferric or even aluminum-nickel-cobalt magnets) to the new (leveraging nanotechnology to get more performance out of smaller amounts of rare earth materials). There's also the obvious route of establishing new supplies.

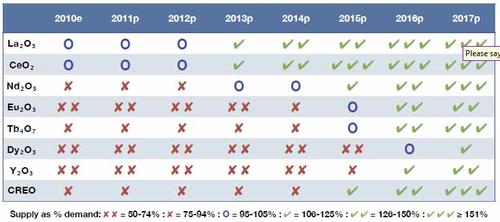

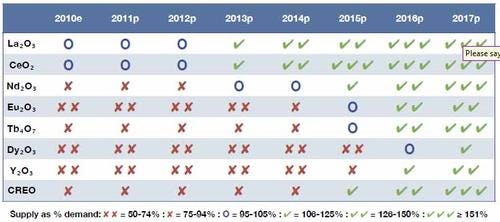

That approach -- opening or reopening mines outside China -- is already under way around the globe. Molycorp Minerals LLC of Greenwood Village, Colo., has secured permits and $781 million in funding to reopen the Mountain Pass mine in California, which was priced out of the market in 2004. According to a new report from Technology Materials Research LLC of Carpentersville, Ill., sufficient sources exist outside China to compensate for the export cuts as early as 2013 for some elements. (See chart.)

The name notwithstanding, rare earth elements, typically processed as rare earth oxides (REOs), are only scarce when compared with abundant elements like iron and aluminum. Significant deposits exist around the world in locations as varied as South Africa and California. China's current position as the dominant global supplier derived from a mix of circumstances.

Several light REOs are the byproducts of iron ore mining, which is one of China's staple industries. The steps required to extract REOs typically involve toxic or even radioactive materials. And in the past, Chinese suppliers have been subject to less stringent environmental regulation than their international competitors, which helped them undercut prices and ultimately capture around 95 percent of the market.

Though the Chinese government began reducing exports of rare earth materials earlier, the skyrocketing prices can be tied to quota cuts that were imposed in the fall of 2010 and led to a year-over-year reduction in tonnage of around 40 percent.

"There was a significant drop in the official export numbers that was reflected in the price for exported materials," says Gareth Hatch, founding principal at TMR. "It caused some efforts within China to stockpile heavy rare earths. Suppliers started applying a surcharge."

About the Author(s)

You May Also Like