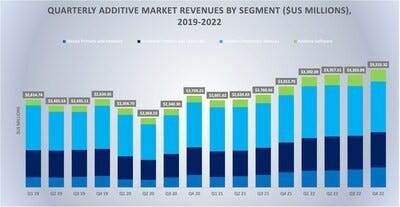

3D Printing Surged 23% in 2022, Reaching $13.5 Billion

Coming off COVID-driven growth, end-use parts and new materials are driving further industry expansion.

March 22, 2023

The fourth quarter of 2022 capped a strong year for additive manufacturing markets, according to SmarTech Analysis. Even in the face of uncertain economic conditions, the growth rate for all 3D printing hardware, materials, software, and services expand by 23% in 2022. The year-end spending on additive manufacturing hit $13.5 billion.

Sectors in the industry expanded at different rates. The metals market grew 25%, to $4.9 billion, while the polymers market grew 20%, to $7.3 billion. The software segment reached $1.2 billion, and the additive manufacturing services totaled $6.0 billion.

Sector-by-Sector Growth

The big movers in additive adoption continued to be aerospace and dental. In both industries, 3D printing has morphed into a matured manufacturing process. Yet other sectors are now showing strong growth. “Though the aerospace industry drove growth in additive manufacturing over the last decade, followed by medical/dental, other sectors are starting to catch up with growing adoption, particularly leading up to and after COVID hit,” Michael Molitch-Hou, editor-in-chief of 3DPrint.com, told Design News. “Specifically, automotive and, more recently, oil and gas, have been using the technology at increasing rates.”

Another change in the market is the acceptance of 3D-printed parts in automotive manufacturing. “While automotive has long been a user of the technology since its inception in the 1980s and 90s, automotive has only begun using 3D printing for end parts more recently. Previously it was too expensive for implementation,” said Molitch-Hou. “Now, there are higher throughput printers on the market that reduce the cost.”

A new player in additive manufacturing in the energy sector. “For the oil and gas industry, the energy transition driven by climate change and high fossil fuel prices, is demanding that the cost of energy be reduced,” said Molitch-Hou. “Ideally, this would be performed through the adoption of renewable energy technologies, but more realistically, fossil fuel companies and users are doing this by adopting additive manufacturing to improve the efficiency of systems that rely on fossil fuels, such as more energy-efficient engines and power generators.”

Growth Slowed Slightly in the Second Half of 2022

While growth in 3D printing during 2023 was aggressive, the second half slowed a bit. “Most areas grew aggressively in the first half of the year, and still achieved growth in the second half despite the deteriorating economic outlook,” Scott Durham, EVP of research at SmarTech Analysis, told Design News. “However, in the metals segment – which grew a little faster compared to nonmetal 3D printing – the area of powders used by additive manufacturing machines grew quite a bit in 2022, nearly 50%.”

The overall growth over the years was balanced by defense and aerospace. “Industry growth may have happened regardless of all the supply chain shakeups which are generally credited for a lot of renewed interest in additive manufacturing due to multi-year development projects now picking up steam. All of the activity in the defense/hypersonics and aerospace sectors helped a lot,” said Durham.

The Pull for Manufacturers

Much of the growth in 3D printing has been driven by manufacturers that are adopting the technology at a greater speed than in previous years. “The value proposition hasn't changed - it's all about getting parts that might be very difficult to source a lot faster, and in many cases with lower overall cost,” said Durham. “Sometimes this is through creative design work to combine parts that wouldn't be possible otherwise; sometimes it’s about making things without the need for a mold or tooling. In the post-pandemic supply chain world, this value proposition has become even more relevant.”

Supply chain issues are still behind a lot of the decisions to utilize 3D printing. “The biggest driver of adoption right now is supply chain resilience. COVID and the military conflict between Russia and Ukraine, among other macro events, have highlighted issues in the supply chain that require local, on-demand solutions,” said Molitch-Hou. “3D printing showcased its ability to execute this during COVID and now, manufacturers understand the potential of the technology in the long term.”

Another mover in 3D printing growth is government incentives to buffer unstable supply chains. “National governments are implementing a variety of programs that are directed at supply chain resilience, which is being passed onto the additive manufacturuing industry and designed to integrate the technology into the supply chain of traditional manufacturers,” said Molitch-Hou. “This will only be compounded as energy transition is more fully pursued because much of that will require local, on-demand manufacturing using as few materials and as little energy as possible, something that AM is optimally positioned to achieve.”

About the Author(s)

You May Also Like