In the development of self-driving vehicles, Tier Two suppliers say they’re communicating directly with automakers in ways they hadn’t previously.

April 18, 2017

During a two-week period in early February of this year, Chris Jacobs of Analog Devices, Inc. (ADI) criss-crossed the country, visiting the offices of virtually every major automaker to discuss such technologies as radar, Lidar, and microelectromechanical sensors.

A decade ago, Jacobs wouldn’t have gotten his foot in the door with the automakers to discuss such subjects. But thanks to the emerging importance of self-driving cars, Jacobs says he and his colleagues have suddenly become very important.

“Just in the last year, it’s been insane,” Jacobs, general manager of ADI’s advanced driver assistance systems and automotive safety, recently told Design News. “Now, the OEMs [automakers] want to develop non-disclosure agreements with us. And they want us to develop prototypes for them without a Tier One [supplier], so they can try them out on their test tracks. This would have never happened 10 years ago.”

Indeed, the time-honored order of the automotive supply chain seems to be changing, and the autonomous car may be behind it. In the past, Tier Two vendors, such as Analog Devices, didn’t communicate with automakers. Rather, they reported almost exclusively to the Tier Ones, such as Delphi Automotive PLC, Robert Bosch GmbH, Visteon Corp. and Continental AG. The Tier Ones, in turn, worked with the automakers to build bigger products, integrating sensors, software, semiconductor chips, and other parts from the Tier Twos. Under such arrangements, Tier Twos were generally discouraged from contacting the OEMs (the automakers) directly.

“We would want to talk to them, and they would say, ‘Talk to the Tier One,’” Jacobs said.

Now, that’s changing. Today, Tier Two electronics suppliers say they’re connected directly to the automakers on a separate dotted line – at least when it comes to autonomous cars. They’re neither more nor less important than the Tier One. Rather, they’re on an equal footing. So instead of handing over their semiconductor chips and sensors to the Tier One, they’re now laying them out on a table in Detroit or somewhere else to be examined by vehicle engineers.

|

Automakers are communicating directly with Tier Twos to meet the growing need for radar sensors. Analog Devices rolled out Drive360, an autonomous vehicle radar technology, in February, 2017. (Source: Analog Devices, Inc.) |

The underlying reason comes down to intellectual property. In the arena of self-driving cars, automakers are furiously seeking an edge. The best way to do that is to go directly to the source of the innovation, which is, in some cases, the Tier Two.

“The auto manufacturers want to determine their own future, rather than being dependent on what a Tier One provides to them,” noted Ian Riches, director of Strategy Analytics, an industry analyst. “They want to do the work themselves, understand what’s required, and develop it, so that their technology is relevant going into the next 20 or 30 years.”

A Patchwork of Partnerships

Evidence of that phenomenon is easy to find. In January, BMW Group, Intel Corp., and MobilEye N.V. announced they were partnering on autonomous technology. Both Intel and MobilEye are considered Tier Two suppliers. Similarly, General Motors invested more than $1 billion in tiny Cruise Automation last year, while Ford invested in Velodyne Lidar, Inc. Again, both would technically be considered Tier Twos.

To be sure, Tier Ones are no less involved in these arrangements than OEMs. Delphi Corp., too, has partnered with MobilEye, as well as with Lidar maker, Quanergy Systems, Inc. Bosch recently teamed with Nvidia on “deep-learning artificial intelligence” and Continental acquired a division of Advanced Scientific Concepts that makes Lidar sensors.

The upshot is that, when it comes to autonomous cars, the auto industry is now a patchwork of partnerships between OEMs, Tier Ones and Tier Twos. The straight-line hierarchy is fading fast.

|

Increasingly, OEMs are forming partnerships, or even acquiring, suppliers. In 2016, GM president Dan Ammann (right) greeted Cruise Automation co-founders Kyle Vogt (center) and Daniel Kan (left) after the giant automaker acquired Cruise for an estimated $1 billion. (Source: GM) |

Some Tier Two suppliers, as well as automakers, say that the autonomous partnerships are merely the visible part of the changing landscape. Direct line communication between OEMs and Tier Twos, they say, has been quietly taking place for nearly a decade.

“It’s been happening in infotainment, cockpit instrumentation and safety systems,” Amrit Vivekanand, vice president of automotive for Renesas Electronics America, told Design News. “What’s new is that the OEMs want to take a more direct hand in the selection of silicon. And the discussion about Level 5 autonomy is accelerating those relationships.”

What’s also new is the added element of public urgency. In 2016, the National Highway Traffic Safety Administration (NHTSA) mandated the addition of automatic emergency braking as a standard feature on all new vehicles by 2022. That’s a concern for automakers because it means that the average vehicle could have as many as six radar sensors on board in a few years, compared to one today. And that, in turn, translates to a sudden bulge in the automaker’s bill of materials, because radar sensors and associated parts typically cost $50 to $80 each.

“By 2022, we’re going to have to take a zero off that figure because radar will no longer be a premium option,” Jacobs said.

The same goes for Lidar (light detection and ranging) systems. The best Lidar systems today are pushing $8,000, which is an unrealistically high cost for most vehicles. Again, automakers are looking to cut that cost, and they need to partner with Lidar developers to make it happen by the 2030 time frame.

Software, too, is driving a need for partnerships. The proliferation of cameras, radar and Lidar sensors means that automakers suddenly have a dire need for sensor fusion software to help them sort through the sea of signals being transmitted to the vehicle’s processors.

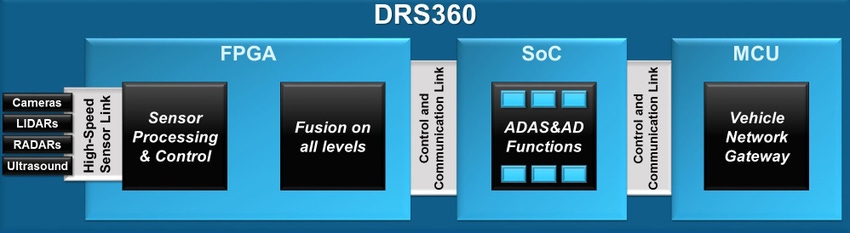

Mentor Automotive, which recently unveiled a sensor fusion package called DRS360, said it has seen a sudden surge in direct communication from automakers. “They explained to us that they wanted to develop their own unique capabilities,” Glenn Perry, vice president and general manager of Mentor Graphics Embedded Systems Division, told Design News. “To the extent that they were relying on Tier Ones, and the Tier Ones were also serving their competitors, it constrained how much differentiation they could put into their products.” The solution, Perry said, was simply for the automakers to work directly and discreetly with Tier Twos.

Such changes in the time-honored supply chain order aren’t necessarily better or worse, but rather, just new and different. Tier Twos say they’re seeing a change in the behavior of engineers, not only at the OEM level, but at the Tier Ones, as well. The old model, where an OEM delivered a request for quotation to the Tier One, and the Tier Two responded to Tier Ones, is being disrupted, and all the players are beginning to understand that.

“The OEM-Tier One-Tier Two structure will continue to exist in some fashion,” Jacobs concluded. “But it’s going to be more a triangle than a straight line.”

Senior technical editor Chuck Murray has been writing about technology for 33 years. He joined Design News in 1987, and has covered electronics, automation, fluid power, and autos.

Advanced Technologies at ESC Boston. The future is now. VR, augmented reality, embedded speech, artificial intelligence, and autonomous vehicles are already reshaping the tech landscape. Learn how these innovations will impact your work at the Embedded Systems Conference’s new Advanced Technologies track May 3-4. Register today.

About the Author(s)

You May Also Like