The Center for Automotive Research breaks down the potential uses of steel, aluminum, polymers, and magnesium as automakers seek to reduce the weight of cars.

Michigan’s Center for Automotive Research has investigated the potential for various materials to aid in reducing the mass of vehicles, producing a list of pros and cons for each of the options.

CAR researchers examined the changes for U.S. new cars between 2015 and 2020 and produced a forecast looking at 2025 to 2035. They interviewed engineers at automakers to learn what issues they are facing and heard about the difficulty of reducing weight while switching to electric powertrains.

Respondents indicated that they’re looking for affordable high-volume manufacturing techniques for lightweight materials and pointed out the need to be able to join dissimilar materials to maximize weight savings. Predictive computational and design-optimization tools are seen as crucial needs to achieve this.

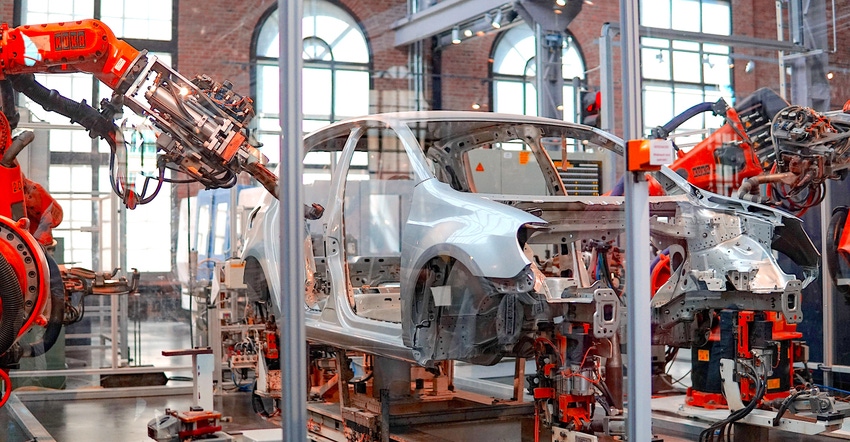

Perhaps unsurprisingly, CAR researchers learned that closure panels such as doors, hood, and trunk are a top priority because they are large, mostly flat bolt-on parts. The body-in-white (BIW) main chassis is the next most important, as a part with significant mass. Those were followed by unsprung mass in the suspension, interior components, and powertrain.

With these things in mind, CAR identified the advantages and negatives of each of the four primary candidate materials for reducing weight in future vehicles.

Steel

Steel is and will continue to be the most widely used material for the foreseeable future. With this in mind, the steel industry is continuing to develop better grades of steel, produced more efficiently, and at lower cost.

Advantages

Broad UTS range: 200 Mpa to 2000 Mpa in the last 20 years

Low Cost

Reasonable weight savings using UHSS, Gen-3

Familiarity

Global supply chain

Future Opportunities

Steel industry is focusing on improving formability while increasing strength

All steel makers are actively updating infrastructure to lower their carbon footprint. Example: Nucor, Big River and others moving heavily to EAF (electric arc furnaces)

Significant increase in battery energy density and reduction in battery cost might drive automakers to reassess their priorities for lightweighting for shifting investments to other technologies like ADAS.

Expected to be 50-55 percent of the BIW plus closures.

Negatives

Aluminum and polymer composites provide 30 percent-60 percent MR and actively investing in cost reduction.

Mass add-back due to autonomous technology can force automakers to lightweight further by switching to other materials.

Aluminum

Aluminum is steel’s main challenger, thanks to a 35-40 percent mass reduction over lower grade steels. It is a known commodity with a well-established global supply chain. CAR predicts that aluminum will increase from the current 10-13 percent to 20-22 percent of the BIW and closures subsystem.

Advantages

Aluminum provides 35-40 percent mass reduction over mild steel.

Aluminum content has increased from 200/lbs. per vehicles in 2000 to over 400 lbs./vehicles in 2020. This growth is driven by use of aluminum in hoods and other closures

Aluminum claims to be the most recycled material in the world, 70-80 percent

Global supply chain

Future Opportunities

Doors and other bolt-on components will continue to be an opportunity for Aluminum.

Industry is working on new 6xxx and 7xxx grades (gen-2 and gen-3)

Continuous casting has potential to reduce conversion cost of aluminum sheet products.

Few premium brands such as Audi, Jaguar prefer aluminum

Expected to be 20-25 percent of the BIW+closures

Negatives

The manufacturing plant is totally disrupted by AL alloys and the usage of adhesives. This really explodes the cost, so high volume, totally new platform vehicles are the best applications.

BIW shift to aluminum has not picked up after Ford F-series trucks and Tesla Model S. In-fact, other automakers have chosen a AHSS strategy for high-volume vehicles (for example, Chevy Silverado, Tesla Model 3).

Significant increase in battery density and shift of investment to ADAS can limit lightweighting initiatives.

Polymer Composites

Polymer composites can be much lighter than steel and aluminum while providing the opportunity to simplify parts’ design and number. They could become the dominant material for premium, performance-driven vehicles, but the cost will remain a challenge for high-volume production.

Advantages

Polymer composites like CFRP, GFRP, SMC offer potential for 60-70 percent lightweighting

Part consolidation and low tooling cost lower overall cost.

Future Opportunities

Opportunities in liftgate, door inner, fender, roof panel, front bulkhead, floor reinforcement, A/B pillar reinforcement, truck bed, seats

Expected to be 8-12 percent of the BIW plus closures.

Negatives

In terms of $/lbs., polymer composites will remain expensive over metals.

Major barriers

High raw material cost

Different tooling than metals

Paint shop for BIW applications

Joining

Design

Magnesium

Magnesium promises weight savings similar to that of polymer composites, but it suffers from galvanic corrosion issues when used with other materials. There are also supply chain, forming, and brittleness challenges.

Advantages

Magnesium provides 60-70 percent mass reduction over mild steel.

Future Opportunities

Limited opportunities in vehicle front end components and powertrain castings

Expected to be 3-6 percent of the BIW plus closures

Negatives

Use of magnesium remains low (1 percent) and is limited to inner body parts. Examples: liftgate inner, IP beam, seats

Major barriers:

High cost and limited supply chain

Low formability

Corrosion issues

Joining

About the Author(s)

You May Also Like