After a dip in sales during 2020, the industrial robot market is set to take off again in 2021, according to Interact Analysis.

December 2, 2020

The industrial robot market was coming out of a slump when the pandemic hit. According to Interact Analysis – a company that provides market research for the automation sector – global industrial robot shipments experienced negative growth for four consecutive quarters from mid-2018. By the end of 2019, recovery signs appeared, and the mid-term growth rate turned positive. The downturn in robot sales matched a slowdown in manufacturing overall. Robot sales ticked up as manufacturing began its comeback.

Interact’s research reveals that the decline in robot sales had narrowed by the beginning of 2020. Investment in industrial robots was projected to pick-up, with stronger growth expected through the year. Then, the outbreak of COVID-19 put the brakes on the return to growth.

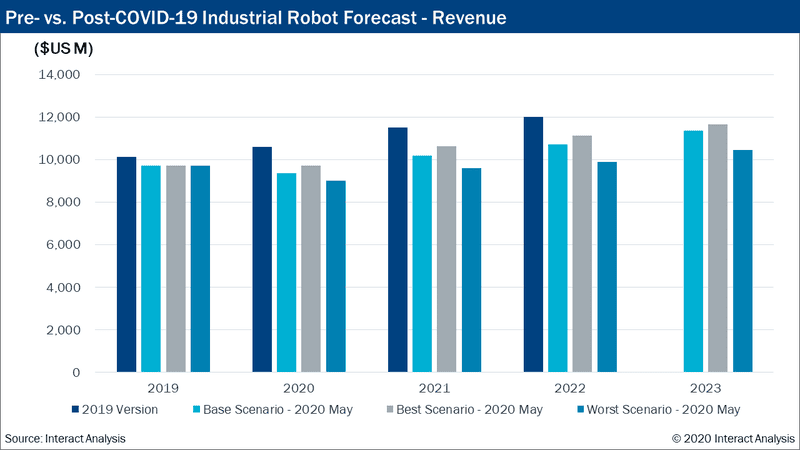

Interact produced neutral, positive, and negative scenarios to reflect the possibilities of the robot market going forward. The pandemic will lead to a long-term increase in rates of factory and warehouse automation but even in the best possible case scenario, Interact doesn’t expect revenues to return to pre-COVID forecast rates before 2022.

The Three Main Conditions of the Robot Market from Interact’s research:

After a weak 2019, it was expected that the 2020 robot market would recover strongly, but COVID-19 changed the market revenue growth forecast from 4.8% to -3.6%

The market will return to rapid growth in 2021 and, in the long run, the pandemic will accelerate existing trends for industrial automation

The Asia-Pacific region suffered least in 2020, however, the current situation in Europe and North America is still highly uncertain

While COVID-19 may have put a dent in 2020 robot sales, ultimately, the pandemic will accelerate existing trends for industrial automation. “This acceleration should be a longer-term trend within three to five years. In the short term, it is the delay and recovery of the market's original demand. From experience, the V-shape of market volatility in 2021 should show an upswing,” Maya Xiao, research analyst at Interact Analysis, told Design News. “The V should follow the previous SARS experience or the financial tsunami of 2008. There will be a big rise after reaching the bottom. But when that starts depends on a vaccine for COVID-19 worldwide.”

Collaborative Robots Sales Will Grow Through the Pandemic

The growth rate of collaborative robots hasn’t been hit as hard at the whole of the industrial robot market. Interact noted the collaborative market will slow, but it will still be in double-digit growth. The reason is that collaborative robots can be quickly placed into effective use, which increases their attractiveness during the pandemic. “Compared with the traditional robot market, the collaborative robot market was originally in its bursting period,” said Xiao. “The original growth rate forecast for 2020 was over 30%. COVID-19 has impacted the market, but it can still maintain positive growth.”

Another reason collaborative robot sales have remained strong is that the sectors that buy collaborative robots have not been hit as hard as the sectors that buy traditional robots. “The industries with more applications of collaborative robots, such as electronics, semiconductors, and logistics, are not as affected by COVID-19 as the automotive industry,” said Xiao. “The installation, commissioning, and training of industrial robots require manpower, and the COVID-19 control measures make this impossible. Relatively speaking, collaborative robots are easier to use, and some urgent orders have appeared.”

To some extent, the rate of return-to-growth will depend on the regional conditions of individual markets. “The impact of the virus will vary considerably by region due to the speed of measures being implemented to contain it. We’ll see APAC recover first, followed by Europe and finally North America,” said Xiao. “As such, APAC will see the first and quickest recovery, with less impact on 2020 compared to other regions.”

Supply Chain Disruptions Won’t Hamper Robot Makers

While some industrial sectors have been slammed by problems in their supply chains, the robot market has mostly avoided supply issues. “Compared to automobiles and other manufacturing industries, the supply chain of the robot industry is not too long, and the inventory of most system integrators is not low, so the supply chain has not been greatly affected by COVID-19,” said Xiao.

Some robot companies have switched some of their suppliers, but any scarcity in the market has not affected prices. “Technical barriers still exist in the robot supply chain, which can make it difficult for local rapid replacement, but the price of core components has not fluctuated significantly during the pandemic,” said Xiao. “In China, there has been a trend to replace imported products with domestic core components since 2018. Because the situation is still dynamic and changing, our analysis is based on the current situation.”

Rob Spiegel has covered automation and control for 19 years, 17 of them for Design News. Other topics he has covered include supply chain technology, alternative energy, and cybersecurity. For 10 years, he was the owner and publisher of the food magazine Chile Pepper.

About the Author(s)

You May Also Like