Faced with challenges on multiple fronts, many manufacturers are bolstering their service subscriptions to leverage a return to growth.

October 7, 2020

Manufacturers have faced am uphill battle during the pandemic, from supply chain and workforce disruptions to demand upheavals. Yet the overall outlook for the sector remains strong. Manufacturers were already a year into contraction before COVID-19 hit, so they were already looking to reinvent their business models around digital offerings.

Many of upped their subscription offerings. Caterpillar noted in its Q1 report that the company would continue to prioritize investment in its subscription services business even as the company cut back on salaries and operational costs. In its Q1 report, IBM reported that 60% of its revenue was derived from subscription sales.

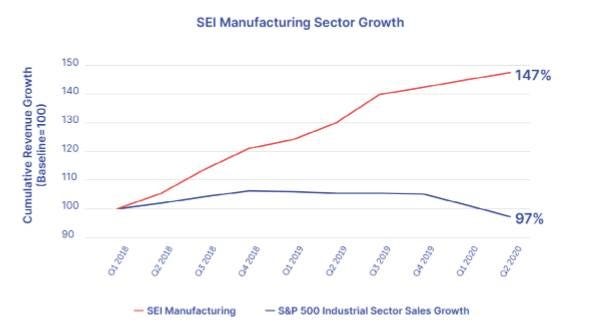

In its annual Subscription Economy Index (SEI), Zuora noted that manufacturers with subscriptions are continuing to outperform their S&P counterparts as they rebuild after shutdowns. Companies with subscriptions have seen a 7% revenue growth compared with an 8.1% revenue decline for S&P counterparts that don’t offer subscriptions. The report noted that the subscription economy has remained resilient, demonstrating steady growth.

The manufacturing portion of the SEI index includes companies that offer fabrication services, industry-specific software, industrial design, heavy equipment, and tools. The SEI also provides an IoT index that includes a broad mix of several industries including security, technology, energy, transportation, scientific instruments, and construction. All of the companies in this index manage digital services based on connected hardware.

We caught up with Amy Konary. global VP of the Subscribed Strategy Group at Zuora and chair of the Subscribed Institute.

What Are Subscriptions in Manufacturing?

Design News: Explain how manufacturers have using the subscription model

Amy Konary: In manufacturing, subscriptions are typically tied to a service, often those made available through IoT devices and technology. They’re valuable because they can extend the lifetime of products, providing customers with more data insights (such as machine utilization and workforce monitoring) and a reduction in operating expenses. For example, instead of selling a product as a one-time transaction, a manufacturer may sell regular maintenance, safety analysis, or location tracking for devices as a subscription.

This is true particularly within IoT services. Caterpillar leads in the space. It is driving value for customers by equipping its smart machines with the power to analyze a huge number of data points and plugging that into its proprietary algorithms. This is helping to monitor, manage, and enhance its job sites in four key areas: equipment management, safety, sustainability, and productivity. By the end of 2019, Caterpillar had 1 million connected assets sending information to its platforms, and, just a few months ago, confirmed that it is prioritizing spending to allow continued investment in services, a key element of its strategy for profitable growth.

Manufacturers with Subscriptions Outpace Their Peers

Design News: How has the pandemic impacted this model? How about post-pandemic?

Amy Konary: Today’s pandemic is accelerating the growth of the subscription economy across the board. I am the founder and chair of the Subscribed Institute. We provide the Subscription Economy Index, which measures the health and growth of hundreds of subscription companies around the world.

This year, the report found that subscription businesses are continuing to outperform their product-based peers, growing revenues approximately 6X faster than S&P 500 companies. This is also true for manufacturers monetizing with subscription-based digital services. They outperformed their S&P counterparts as they rebuilt after shutdowns. The difference was 7% revenue growth versus 8.1% revenue decline in Q2 2020.

Historically, much of the growth of digital subscription services in manufacturing was prompted by the need for companies to look for ways to increase efficiencies and cut costs. The pandemic added the extra concern of employee health. The resulting financial crisis only compounded the need to maximize ROI. Increasing automation through IoT has reduced worker density, increased machine productivity, and improved the workforce overall.

Post-pandemic we expect to see continued growth and increased competition. Moving forward, manufacturers must continue to assess their toolbox of pricing strategies and other elements related to the subscriber experience. They can shift from free trials and tailored customized packages in order to retain customers and continue to grow accounts and revenue.

Subscriptions Have a Long History in Manufacturing

Design News: How long has this model been apparent in the manufacturing industry?

Amy Konary: Subscriptions have been around for decades. However, the rise of the IoT has maximized its value and increased its popularity. The stability of the recurring revenue model has been a key growth strategy during the pandemic, so many manufacturers have shifted more of their business to subscriptions.

For example, Honeywell has truly used IoT to its advantage, evolving from a traditional manufacturer of solely focused on products, into an industrial software and services company. Last year the company launched Honeywell Forge, an enterprise performance management software that provides insights to operators of buildings, airlines, industrial facilities, and other infrastructure. Usman Shuja, Chief Commercial Officer for Honeywell Connected Enterprise, recently said, “Honeywell Forge is being built on the premise that the entire physical world is going to be connected.”

Subscription Model Transcends Industry Sectors

Design News: What type of manufacturing industries use this model: Medical supplies? Consumer goods? Auto? Food & Beverage?

Amy Konary: The subscription model can be used across the board. It’s not specific to any one product or industry. Products sold by manufacturers are only a way to reach a higher goal, such as removing dirt or building a house. To create a subscription service, manufacturers should be thinking about the true goal of our outcome desired by their customers, and how they can best provide this value.

Look no further than Ford. The company launched its new EV Mustang Mach-E with a subscription service to a nationwide network of over 13,000 electric charging stations. Or Arrow Electronics, a Fortune 500 electronics manufacturer which started in 1935 by selling radio sets. The company now offers a Sensor to Sunset IoT service which is built to help design, monitor, and complete projects, rather than simply providing materials. It is essentially a comprehensive solution addressing everything from sensors, wireless connectivity, gateways, and analytics to security.

Another great example is Philips, a 135-year-old company that seamlessly transformed its business to meet digital demands, from innovative healthcare to lighting-as-a-service and more.

Design News: What size manufacturers use this model? Just the largest manufacturers? Is it gaining traction in small- to mid-size manufacturers?

Amy Konary: The subscription model – and in particular leveraging Industry 4.0 technologies and IoT to launch valuable digital services – isn’t limited to a single company structure.

Manufacturers of all sizes are steadily innovating to meet the demands of today’s consumers – and they are reaping the rewards of these end-to-end customer-centric business models. Any manufacturer focused on enhancing its traditional offerings by adding a layer of convenience and flexibility – and additional value – for customers are the ones that will continue to thrive.

Rob Spiegel has covered automation and control for 19 years, 17 of them for Design News. Other topics he has covered include supply chain technology, alternative energy, and cybersecurity. For 10 years, he was the owner and publisher of the food magazine Chile Pepper.

About the Author(s)

You May Also Like