BDO has investigated how the pandemic is affecting manufacturing and whether changes will continue beyond immediate demands prompted by the pandemic.

September 29, 2020

Remember March? We expected to count the coronavirus disruption in weeks. The kids would be back in class in May before the school year ended. We expected to soon see toilet paper restocked on the grocery shelves. Meanwhile, many of us were buying TP direct from a local manufacturer.

Well, the whole mess continued on and on. Target and Walmart sent in larger-than-normal orders for TP and hand sanitizer, consumers flocked to Amazon, and the trend of buying directly from manufacturers grew. The variety of choices on the shelves – 15 different styles of Oreos – were deprioritized in favor of making sure there was something on the shelves at all. Manufacturers revamped their supply chains to plug holes, reshoring a bit.

Add all of these changes together and you find that manufacturers are revamping their business models.

BDO has looked into how manufacturers are responding to changing consumer buying habits. The firm’s researchers also looked into whether these changes are likely to continue beyond the immediate demands prompted by the pandemic. In its study, 2020 Middle Market Industry 4.0 Benchmarking Survey, BDO looked at how shifts in customer behavior have changed US manufacturing.

The study revealed the following changes in how manufacturers are adjusting to the health crisis. In some cases, such as direct-to-consumer (DTC) sales, the pandemic amplified trends that were already gaining traction.

E-commerce acceleration may lead to supply chain disintermediation as more manufacturers go direct to consumers.

The shift to bulk-buying is causing manufacturers to rethink just-in-time inventory strategies.

There is a shift away from customization as access and availability trump product variety.

Greater focus on spending less and saving more means adjusting pricing and delivery models.

Increased digital customer service interactions mean manufacturers are taking a page from the retail omnichannel playbook.

The Direct-to-Customer Movement

Manufacturers are beginning to sell directly to consumers. This move bypasses the wholesaler and retailer. “Even before the pandemic, 56% of manufacturers were already selling directly to consumers, according to our survey,” Eskander Yavar, the leader of BDO’s Manufacturing Practice, told Design News. “We anticipate this figure to rise. COVID-19 has stimulated this trend. For manufacturers, e-commerce acceleration presents a potential opportunity to increase sales and wallet share while also using the data to serve customers more effectively.”

As the DTC model expands, it could lead to widespread supply chain disintermediation across a variety of industries. “Rather than relying on their distributors’ e-commerce capabilities, manufacturers may consider bypassing the middleman to sell directly to consumers if they haven’t done so already,” said Yavar. “With a DTC model, manufacturers can cut costs and improve efficiency, especially if they have rapid delivery capabilities and can minimize shipping times.”

Another significant benefit of the DCT is that it puts the manufacturer directly in contact with the customer. “The DCT model presents an opportunity for the manufacturer to get closer to the customer, leveraging customer data to deepen existing relationships, develop new products, or break into new markets,” said Yavar.

Bulk Buying Shifts Inventory

The pandemic has put a sizable dent in the decades-long trend toward mass customization – the use of mass production methods to create individualized products. “The challenge of mass customization during COVID-19 is that it takes a greater amount of resources, which is costly,” said Yavar. “If you offer only one product with no customization, then the resources you input into the production of one unit will remain static.”

In the early days of the pandemic, consumers started buying undifferentiated goods in bulk. “High demand for certain items at the beginning of the pandemic – famously, toilet paper and hand sanitizer – led to some customers, like grocery stores, to buy products in bulk to try to keep store shelves stocked,” said Yavar. “These high-volume orders require manufacturers to keep high volumes of inventory on hand. This is especially hard if supply chains are disrupted. Aside from finished product inventory, manufacturers also needed to increase their inventory of product inputs, in particular intermediary products.”

This trend discouraged manufacturers from mass customization efforts. “Lean intermediary product inventories can worsen delays in production if supply chains are disrupted. The more resources you need, the more potential for delays and disruptions,” said Yavar. “As a result, mass customization, with its large variety of intermediary products and resources, is less than optimal in the current environment.”

Mass-Customization Gets Sidelined

The BDO survey showed that shortages and manufacturing delays due to the pandemic disrupted product delivery. The higher costs of customization caused customers and manufacturers to consider the question: how much variety do we need? “Think about grocery store shelves,” said Yavar. “Before, you would see fifteen different varieties of one product. During the height of the pandemic and shutdowns, that selection was restricted to only three or four.”

It isn’t just grocery stores simplifying their variety – according to the Wall Street Journal, businesses from motorcycles to restaurants have scaled back variety in favor of profitability. “The pandemic and ensuing recession have shifted consumer priorities,” said Yavar. “Where customization was previously desirable, consumers are now focused on the availability of products.”

The shift has also prioritized durable, reliable products at lower prices. “Customization options tend to increase prices and decrease the speed of delivery, making them less attractive in the present environment,” said Yavar. “With the economy recovering only slowly, and a potential second wave of the virus pending, these priorities are unlikely to revert quickly. Manufacturers who sell directly to the consumer are likely to see greater impacts from these shifts in consumer demand than manufacturers who sell to other businesses.”

Pricing and Delivery Get Revamped

Customer behavior has changed during the pandemic as consumers face financial strain. BDO’s survey reveals that some manufacturing subsectors such as electronics and toy brands have seen increases in consumer demand, while others such as apparel have seen decreases.

Given this environment, BDO noted that manufacturers need to be agile in managing production and inventory. “Manufacturers who sell to customers in subsectors where consumer demand has decreased have likely seen their customers shift from spending to saving,” said Yavar. “As the pandemic continues, with a potential wave in the future, customers in industries that have very elastic demand will likely continue to be conservative in their spending.”

Manufacturers Create Customer-Facing Services

Yavar noted that the pandemic has accelerated the digital economy. Digitally brands and traditional brands with digital capabilities have had an easier time responding to the pandemic than competitors that are less digitally astute. “This is certainly evident in the retail industry,” said Yavar. “Manufacturers are increasingly taking steps toward automating customer service, including implementing online forms, chatbots, or fully remote customer support staff to answer customer questions and respond to complaints.”

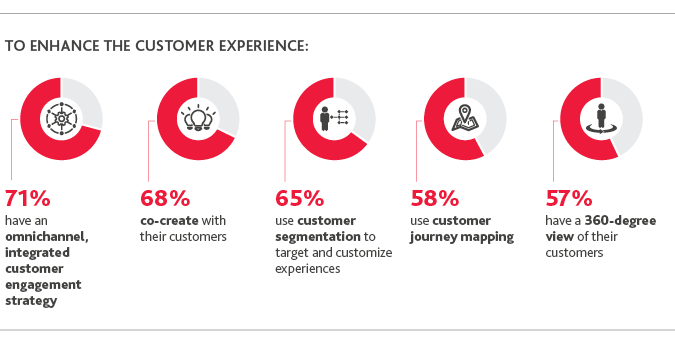

BDO’s survey indicated that even before the pandemic customer service was a top target for manufacturers as they worked to improve their supply chains. “This trend emerged even before we found ourselves in the current environment,” said Yavar. “Manufacturers see the value in interacting with their customers even after the sale to gain deeper insight into their preferences and adapt accordingly. The goal is to create seamless omnichannel experiences and encourage repeat purchase orders.”

What Steps Can Manufacturers Take?

Yavar noted that are some specific steps manufacturers can take in response to changing consumer behavior:

Reconsider tactical pricing decisions from the pre-pandemic era. Are you providing steep discounts to less-than-ideal target customers? If so, these pricing decisions need adjusting. Steep discounting should be saved for customers that generate high ROI. Make sure you aren’t losing money with your pricing model.

Pinpoint and phase out underperforming products. If a product takes company resources but provides little ROI, it’s time to discontinue the item and shift to higher-performing products. This will help to optimize resources and maximize profitability.

Make the cost base variable. This can be accomplished by cost transformation, wherein fixed costs are converted to variable ones, which can significantly increase capital efficiency and financial flexibility.

Adopt omnichannel selling. Offering multiple potential avenues through the buyer journey to facilitate customer convenience makes a company more attractive. Apps, online shopping, curbside pickup, and customer service chatbots can give your customers a smoother buying experience.

Increased digital customer service interactions mean manufacturers should take a page from the retail omnichannel playbook.

Rob Spiegel has covered automation and control for 19 years, 17 of them for Design News. Other topics he has covered include supply chain technology, alternative energy, and cybersecurity. For 10 years, he was the owner and publisher of the food magazine Chile Pepper.

About the Author(s)

You May Also Like