Robot adoption has slowed during the pandemic, putting a damper on the robot market. Real growth may wait until 2022, although Cobot growth may not have to.

July 9, 2020

The robot market was just coming out of a manufacturing slump when the pandemic hit. That took positive forecasts and turned them upside down. Meanwhile, the cobot market may actually survive the pandemic’s blow to the robot market and come out with positive results for the balance of 2020 and into 2021. The good news for cobots, is partly a result of higher sales in Asia where manufacturers are emerging more quickly from the pandemic.

According to data from Interact Analysis, a market research firm that specializes in smart manufacturing, industrial robot shipments experienced negative growth for four consecutive quarters from mid-2018. The downward results happened in the context of a slowdown in general global manufacturing activity, which led to weak spending on machinery and automation equipment. By the end of 2019, recovery signs appeared, and the mid-term growth rate turned positive.

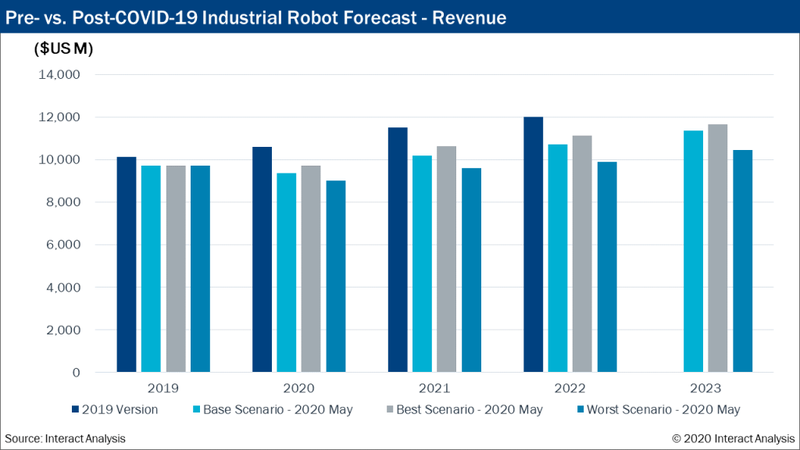

After a weak-but-recovering 2019, Interact Analysis originally expected the 2020 robot market to recover strongly, but COVID-19 changed the market revenue forecast from positive growth of near 5% to negative growth of mare than 3%. Interact expects the market will return to rapid growth in 2021 and, in the long run, the pandemic will accelerate existing trends for industrial automation.

Revised 2020 and 2021 Forecasts

Interact’s new base scenario predicts that the global industrial robot market will drop by 3.6% in revenue, and by 3.7% in shipments during 2020. That compares to a pre-COVID forecast of positive growth of 4.8% and 7.7% respectively. The firm does forecast a strong rebound in 2021, with end users advancing automation plans and projects that were delayed in 2020. All three scenarios suggest a rebound from 2021, albeit in the worst case at a slower pace. The worst-case forecast assumes a much longer pandemic which cannot be contained during 2020, and therefore leads to a prolonged period of high unemployment and low wage growth.

To reflect the rapidly changing nature of the COVID-19 situation, Interact produced neutral, positive, and negative scenarios. The pandemic will lead to a long-term increase in rates of factory and warehouse automation but, even in the best possible case scenario, the firm does not expect revenues to return to pre-COVID forecast rates before 2022.

“This acceleration should be a longer-term trend within 3-5 years. In the short term, it is actually the delay and recovery of the market's original demand,” Maya Xiao, an author at Interact Analysis who is responsible for industrial automation, told Design News. “From experience, the V-shape of market volatility in 2021 should be pulled up. The meaning of the V is that it will follow the previous SARS experience, or the financial tsunami of 2008, and there will definitely be a big rise after reaching the bottom. But when to start depends on the control of COVID-19 worldwide.”

A Rosier Outlook for Cobots

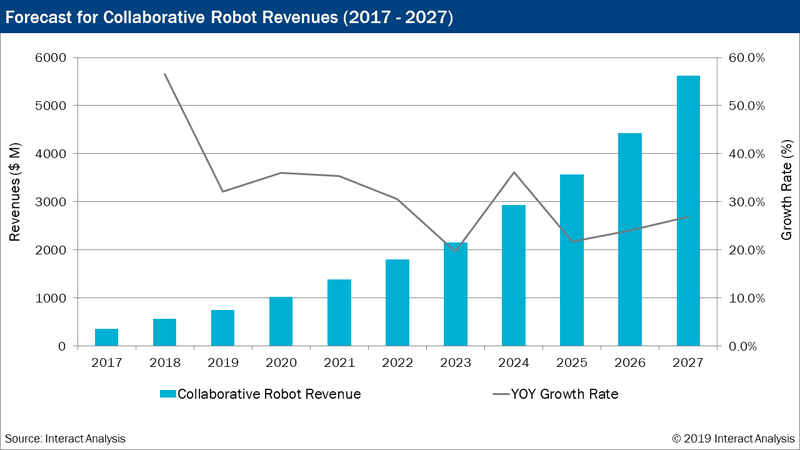

Collaborative robots are expected to maintain a double-digit growth rate in terms of both revenue and shipments throughout 2020. Growth for all other types of industrial robots is either negative or flat. Applications in non-manufacturing environments such as logistics, and service industries will be hit harder, but they will also recover faster. In addition, many collaborative robot manufacturers are concentrated in Asia, meaning they are further through the crisis than their competitors and customers in non-Asian markets.

As for the reasons, cobots are still forecast for positive growth, Xiao points to a number of reasons. “Cobots will be quickly placed into effective use for three important reasons,” said Xaio.

Compared with the traditional robot market, the collaborative robot market in its bursting period when the slowdown and pandemic hit. The original growth rate forecast for 2020 was over 30%. COVID-19 has impacted the market, but it still maintains positive growth.

From the perspective of the application industry, the industries with more applications of collaborative robots, such as electronics, semiconductors, and logistics, are not as adversely affected by COVID-19 as the automotive industry.

The installation, commissioning, and training of industrial robots require manpower. The COVID-19 control measures of make these impossible. Relatively speaking, collaborative robots are easier to use, which reduces the need for extensive training during a pandemic.

Which Industries Are Taking Hits

Automotive has been particularly hard-hit. While some large robot orders of more than 1,000 units still being announced, there is no sign of improvement in traditional automobile manufacturing. While traditional cars will not show a quick recovery, new-energy vehicles will be a different story.

Most new production-related investments in automotive are associated with new-energy vehicles. That includes production of automotive electronics and lithium-ion batteries. In Interact’s report, robots used in automotive electronics and LI battery production are not attributed to the automotive industry, and most of that production is in Asian countries. Collaborative robots have experienced strong growth in these areas in the last 12 months.

Industries that were already highly automated, such as semiconductors, were less affected by the COVID-19 lockdown. Hence, COVID-19 has joined other factors, such as general long-term labor shortages in many countries, as a reason for increasing interest in automation among manufacturing companies.

Recovery Will Vary by Region

As for what regions are likely to emerge first, Xiao noted that it depends on how a given region is overcoming the effects of the pandemic. “The impact of the virus will vary considerably by region,” said Xiao. “It depends on the speed of measures being implemented to contain COVID-19. That will occur over shifted timescales: APAC first, followed by Europe, and finally North America. As such, APAC will see the first and quickest recovery with less impact on 2020 compared to other regions.”

She noted that the supply chain for the robot industry has not been hard hit by the 2018/2019 slowdown, so it’s in good shape with withstand the effects of the pandemic. “Compared to automobiles and other manufacturing industries, the supply chain of the robot industry is not too long,” said Xiao. “The inventory of most system integrators is not low, so the supply chain has not been greatly affected by COVID-19.”

Rob Spiegel has covered automation and control for 19 years, 17 of them for Design News. Other topics he has covered include supply chain technology, alternative energy, and cyber security. For 10 years, he was owner and publisher of the food magazine Chile Pepper.

About the Author(s)

You May Also Like